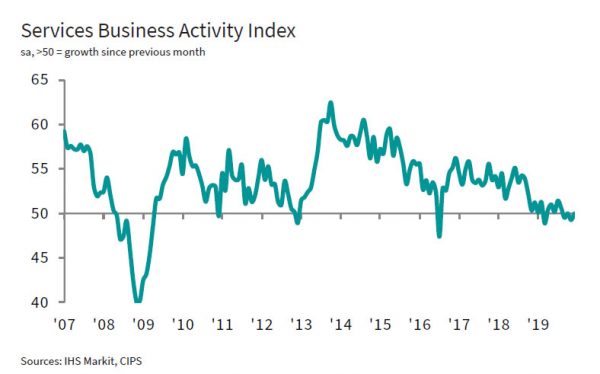

Eurozone PMI Services was finalized at 52.8 in December, up from November’s 51.9. PMI Composite was finalized at 50.9, up from November’s 50.6. Looking at the member states, Italy PMI Composite hit 11-month low at 49.3. Germany PMI Composite recovered to 50.2, revised up from 49.4, hitting a 4-month high. France PMI Composite dropped to 3-month low of 52.0.

Chris Williamson, Chief Business Economist at IHS Markit said:

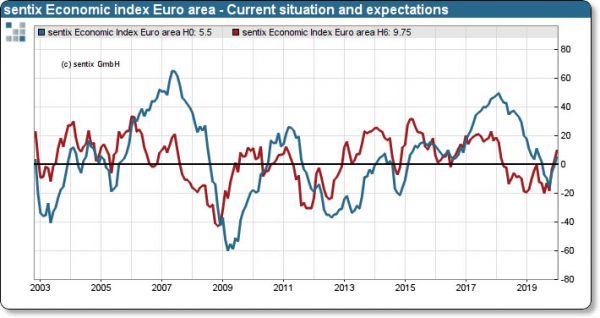

“Another month of subdued business activity in December rounded off the eurozone’s worst quarter since 2013. The PMI data suggest the euro area will struggle to have grown by more than 0.1% in the closing three months of 2019.

“At face value, the weak performance is disappointing given additional stimulus from the ECB, with the drag from the ongoing plight of the manufacturing sector a major concern. However, policymakers will be encouraged by the resilient performance of the more domestically-focused service sector, where growth accelerated in December to its highest since August. Business optimism about the year ahead has also improved to its best since last May, suggesting the mood among business has steadily improved in recent months.

“While the tide may be turning, downside risks to growth in the year ahead nevertheless remain notable. While US-China trade wars have eased, any escalation of trade tensions between the US and Europe will likely hit exports further. Brexit also remains a major uncertainty and is likely to continue to dampen growth in Europe. Nonetheless, in the absence of any major adverse developments we expect to see growth starting to improve as 2020 proceeds, with low inflation and easing financial conditions supporting consumer spending in particular.”

Full release here.

Iran said strikes were proportionate and in self-defense

Iranian Foreign Minister Javad Zarif said that the strike against US force were “proportionate” and in “self-defense”. He added Iran does not seek escalation of war, but will defend against aggression. Hesameddin Ashena, advisor to President Hassan Rouhani, also warned that any retaliation by the US could lead to regional war.

By loading the tweet, you agree to Twitter’s privacy policy.

Learn more

Load tweet

By loading the tweet, you agree to Twitter’s privacy policy.

Learn more

Load tweet