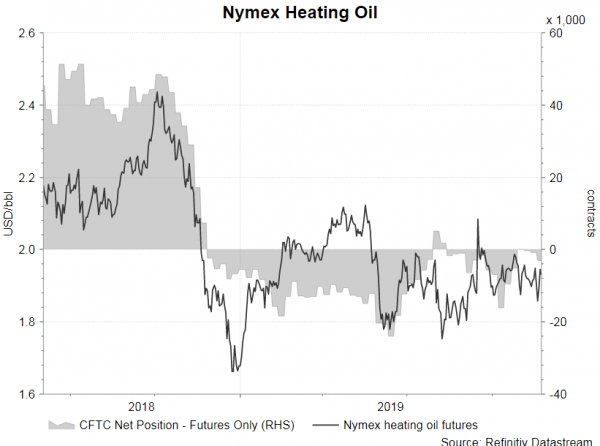

According to the CFTC Commitments of Traders report for the week ended November 19, NET LENGTH for crude oil futures gained +5 378 contracts to 429 975 for the week. Speculative long positions gained +2 338 contracts while shorts dropped -3 040 contracts. For refined oil products, NET LENGTH for gasoline added +2 753 contracts to 76 941, while NET SHORT for heating oil climbed +2 271 contracts to 3 028 for the week. NET SHORT for natural gas futures soared +19 327 contracts to 140 415 contracts for the week.

NET LENGTH for gold futures jumped +18 793 contracts to 285 859. Speculative long positions rose 14 107 contracts, while shorts fell -4 686. Silver futures saw addition of NET LENGTH, by +7 352 contracts to 44 716. Speculative long positions added +571 contracts while shorts fell -6 781. For PGMs, NET LENGTH of Nymex platinum futures gained +3 626 contracts to 42 085 while that for palladium decreased -239 contracts to 10 867.