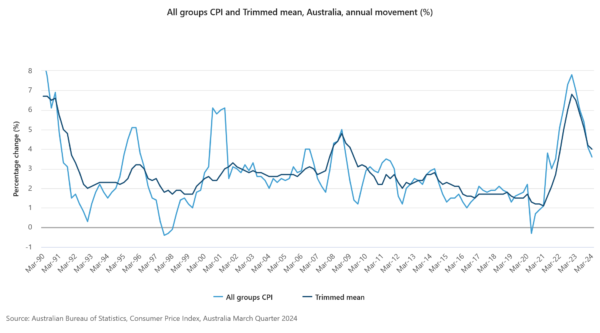

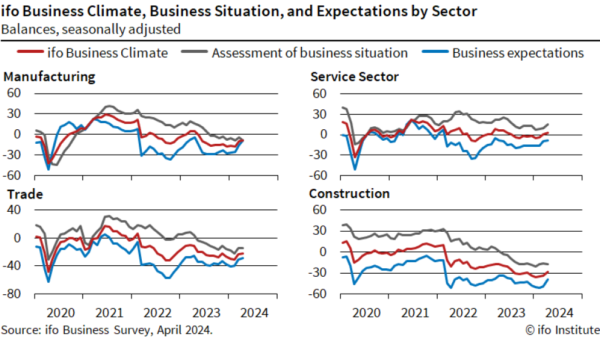

In Q1, Australia’s CPI slowed from 4.1% yoy to 3.6% yoy, exceeding market expectations of 3.4% yoy. Similarly, trimmed mean CPI, which excludes volatile price items and provides a clearer view of underlying inflation trends, also decelerated less than expected, moving from 4.2% yoy to 4.0% yoy, against predictions of 3.8% yoy.

The breakdown by category shows a general slowdown across the board. Goods inflation decreased from 3.8% yoy to 3.1% yoy, while services inflation eased from 4.6% yoy to 4.3% yoy. Tradeable inflation, which includes items that can be imported or exported, slowed more significantly from 1.5% yoy to 0.9% yoy. Non-tradeable inflation, representing goods and services not exposed to international markets, also saw a reduction from 5.4% yoy to 5.0% yoy.

However, on a quarterly basis, CPI rose by 1.0% qoq in Q1, marking an acceleration from the previous quarter’s 0.6% qoq and outpacing expectations of a 0.8% rise. This quarterly increase suggests that, despite the annual slowdown, price pressures within the economy intensified at the start of the year. Trimmed mean CPI on a quarterly basis mirrored this trend, rising 1.0% qoq compared to the previous 0.8% qoq, also surpassing the expected 0.8% qoq.

Monthly figures reinforce the notion of persistent inflationary pressures, with CPI ticking up from 3.4% yoy to 3.5% yoy, again exceeding expectations.

Full Australia CPI release here.

Eurozone economic sentiment falls to 95.6, EU down to 96.2

Eurozone Economic Sentiment Indicator fell from 96.2 to 95.6 in April, below expectation of 96.9. Employment Expectations Indicator fell from 102.5 to 101.8. Economic Uncertainty Indicator fell from 19.3 to 18.8.

Eurozone industry confidence fell from -8.9 to -10.5. Services confidence fell from 6.4 to 6.0. Consumer confidence improved slightly from -14.9 to -14.7. Retail trade confidence fell from -6.0 to -6.8. Construction confidence fell from -5.6 to -6.0.

EU Economic Sentiment Indicator fell from 96.5 to 96.2. Employment Expectations Indicator fell from 102.2 to 101.7. Economic Uncertainty Indicator fell from 18.8 to 18.1.

For the largest EU economies, the ESI deteriorated significantly in France (-4.8) and more moderately in Italy (-1.3), while it improved markedly in Spain (+2.3), Germany (+1.5) and Poland (+1.5). The ESI remained broadly stable in the Netherlands (+0.3).

Full Eurozone ESI release here.