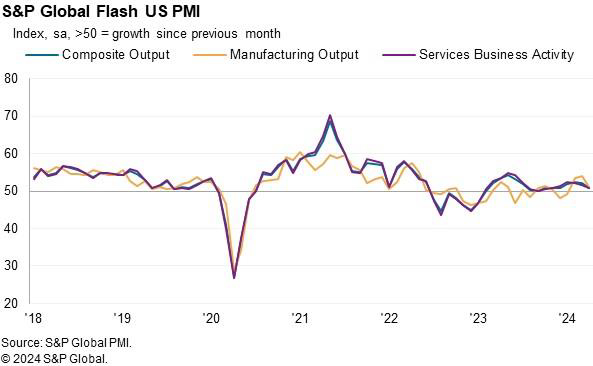

US PMI Manufacturing fell from 51.9 to 49.9 in April. PMI Services fell from 51.7 to 50.9. PMI Composite fell from 52.1 to 50.9.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“The US economic upturn lost momentum at the start of the second quarter, with the flash PMI survey respondents reporting below-trend business activity growth in April. Further pace may be lost in the coming months, as April saw inflows of new business fall for the first time in six months and firms’ future output expectations slipped to a five-month low amid heightened concern about the outlook.

“The more challenging business environment prompted companies to cut payroll numbers at a rate not seen since the global financial crisis if the early pandemic lockdown months are excluded.

“The deterioration of demand and cooling of the labor market fed through to lower price pressures, as April saw a welcome easing in rates of increase for selling prices for both goods and services.

“Notably, the drivers of inflation have changed. Manufacturing has now registered the steeper rate of price increases in three of the past four months, with factory cost pressures intensifying in April amid higher raw material and fuel prices, contrasting with the wage-related services-led price pressures seen throughout much of 2023.”