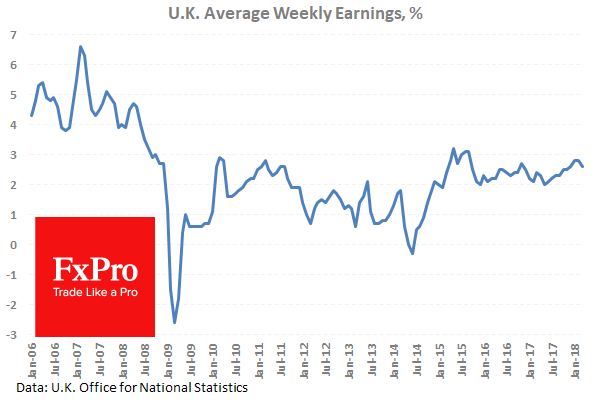

At 08:30 GMT, UK Average Earnings including Bonus (3Mo/Yr) (Apr) is expected to be 2.6% from 2.6% previously. Wage growth is holding steady in the same range for three years now. Any increase could indicate that there is a shortage of available participants to fill vacancies. ILO Unemployment Rate (3M) (Apr) is expected to be at multi decade low 4.2%. Claimant Count Change (May) is expected at 11.3K from a previous reading of 31.2K. The Claimant count has dropped after exceeding expectations and surprising to the upside last month. GBP crosses can be influenced by this data release.

At 08:30 GMT, UK Average Earnings including Bonus (3Mo/Yr) (Apr) is expected to be 2.6% from 2.6% previously. Wage growth is holding steady in the same range for three years now. Any increase could indicate that there is a shortage of available participants to fill vacancies. ILO Unemployment Rate (3M) (Apr) is expected to be at multi decade low 4.2%. Claimant Count Change (May) is expected at 11.3K from a previous reading of 31.2K. The Claimant count has dropped after exceeding expectations and surprising to the upside last month. GBP crosses can be influenced by this data release.

At 12:30 GMT, US Consumer Price Index (YoY) (May) data will be released with an expected reading of 2.8% against 2.5% previously. Consumer Price Index Ex Food & Energy (YoY) (May) data will be released with an expected reading of 2.2% against 2.1% previously. Consumer Price Index Ex Food & Energy (MoM) (May) data will be released with an expected reading of 0.2% against 0.1% previously. Consumer Price Index (MoM) (May) data will be released with an expected reading of 0.2% against 0.2% previously. Consumer Price Index Core s.a. (May) data will be released with an expected reading of 256.897 against 256.450 previously. These data points will allow an updated measure of the effect of inflation on consumers. Inflation is one of the main drivers of market sentiment in the US currently. The expectation is for consumer prices to remain generally the same. USD crosses can see an increase in volatility from this data release.

At 18:00 GMT, The US Monthly Budget Statement (May) will be released with an expected balance of $-135.5B from a previous $214.0B. This data is expected to show a $380B swing into negative territory as seasonal factors affect the calculation of this metric. The previous reading exceeded the high from April 2017 of $182.4B.