Wall Street declined sharply in yesterday’s trading led by Apple’s 9% slide. The Dow declined by more than 600 points while the S&P declined by 62 points. This decline came after a letter from Apple’s Tim Cook that lowered the previous guidance for the first quarter results. He blamed the decline on the Chinese economy and lower demand. While this was a surprise letter, there were a number of red signs. For example, in the past earnings release, the company said that it would stop releasing the number of devices that it sold. In the Asian session, markets were mixed with China’s A50 index gaining by 192 points while Japan’s TOPIX declined by 25 points. US futures point to a higher increase today with the Dow gaining by 80 points.

The biggest news today will be the US non-farm payroll numbers. Investors expect the numbers to show that the economy added 178K jobs, up from the November’s 155K. The unemployment rate is expected to remain at 3.7% while the manufacturing employment is expected to decline by 20K. Average hourly wages are expected to increase by 0.3% from November’s 0.2%. These numbers come a day after ADP released jobs numbers that showed an unexpected increase of 279K people.

Other important news will come from Europe. Investors expect the CPI numbers for the European Union to have remained unchanged at an annual rate of 1.0%. The core CPI that excludes food and key items is expected to move by 1.8%. This will be a point lower than that of November. The PPI for the region is expected to have expanded by 4.1%, which will be lower than the consensus estimate of 4.9%. Data from Canada is expected to show employment numbers. Traders will also listen closely to a speech by Jerome Powell.

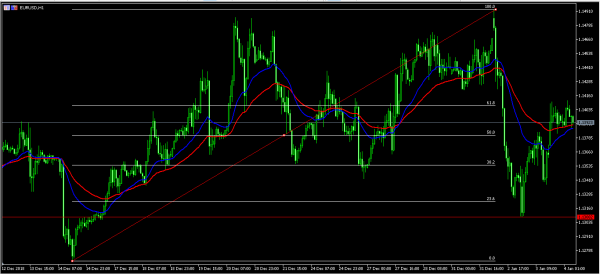

EUR/USD

After dropping sharply on Wednesday, the EUR/USD pair recovered to a high of 1.1412. This level was along the 61.8% Fibonacci Retracement level. As of this writing, the pair is trading at 1.1390, which is between the 61.8% and 50% Fibonacci levels. On the hourly chart, the price is along the 50-day and 25-day exponential moving averages (EMA). This will be a key pair to watch today as traders focus on the employment numbers, CPI numbers from the EU, and a speech by Powell.

USD/CAD

After months of consistent increases, the USD/CAD declined sharply yesterday and landed at a low of 1.3446. As shown below, this level was along the important equidistance channel. It was also below the 50-day and 25-day EMA on the hourly chart. The RSI dropped from the overbought level of 70 to the current 35. Today, this will be an important pair because of US and Canadian data.

XTI/USD

The price of US crude oil has stabilized this year. The XTI/USD pair is trading at 47.26. This is higher than the December low of 42. On the four-hour chart, the price is above the 50-day exponential moving average. Still, the pair is trading near 15-year lows. It is also off by almost 40% since the peak in October. The pair could continue moving higher as sentiment in the market improves.