UK and US investors returned from a three-day weekend with a very cautious tone as no progress was made over the long weekend with the US- China trade war. President Trump, who visited Japan over the weekend, noted the US is “not ready” to make a deal and that tariffs could easily go up. It appears both sides are not close to returning to the negotiating table and that does not bode well for risk appetite. Safe-haven assets are rallying, and bond yields continued to slide. Ten-year Treasury yields are lower by 3.7 basis points to 2.283%, just off the lowest levels since October 2017.

The big US data for the day saw home prices in 20 US cities decline for a 12th consecutive month, implying housing is weak despite a strong decline in rates. Sellers are not seeing any relief and this should start concerning the Fed.

- Euro – Merkel’s heir apparent has second thoughts

- GBP – Election results add fuel to no-deal fire

- S&P 500 – Risk grow for another 5% slide

- Oil – Rises as summer driving season begins and hurricane season nears

- Gold – Could breakout if talks stall until G20

Euro

German Chancellor Merkel’s term ends in 2021 and her transition plan has gone up in dust as she abandons support for Annegret Kramp Karrenbauer (AKK) after she saw CDU’s worst ever performance in a national election. With AKK, leader of the CDU on the outs with Merkel now, it appears the CDU will need a fresh contest for selecting their candidate.

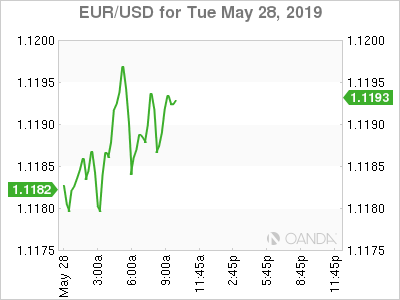

The euro is modestly lower as markets shrug off a batch of mixed eurozone data and focus on battle between Rome and Brussels. While global yields are sliding, the Italian 10-year yield continues to climb, up 3.7 basis points to 2.707%. The European Commission is frustrated with Italy’s lack of austerity and markets should not be surprised they are considering a 3.5 billion-euro fine. Finance ministers will have to agree upon the fine at the next meeting which is expected in a few weeks. With much of the euro zone struggling for economic growth, we could see this become a key debate that gets stretched out beyond the summer.

Brexit

The British pound remains near the lows following the EU elections that saw both pro-Brexit and anti-Brexit parties fare better than the middle. With the Brexit party now insisting to the the Tories that they support a no-deal Brexit, markets are still repricing a hard exit for the pound.

With Labour leaders pushing for a second referendum, Brexit uncertainty remains high and will likely stay that way until we see who become the final two candidates to replace PM May.

S&P 500

Many are surprised stocks are not lower after this past earnings season and trade war escalation. The volume traded has been lighter than one would expect and while we see 2,800 on the S&P 500 index holds, a break below should see high-frequency and algorithmic systems salivate. We are still only 4.4% away from the record highs and we should not see investors turn complacent here. Sell in May could easily become close out in June. Until we see fresh record highs, we technically are still in bear-market territory.

Oil

West Texas Intermediate crude is up 0.8%, while Brent’s gains are closer to 2%, as geopolitical risks support the latter. Crude is tentatively rebounding following the worst loss of the year last week. With demand risks growing from an extended trade war between China and US, markets are closely waiting to see if Trump delivers another tariff blow that will further dampen prospects for a deal to be made and more importantly deter global demand.

Declining rig counts in the US suggest we may see the velocity of US production ease up even further, but still deliver record levels. The driving season should see strong demand from the US, but that is being overlooked by an overall demand decline from the trade war.

President Trump took aim at easing concerns of a full escalation in Iran, but the overall situation remains tense. Risks from Middle East, Venezuela and Libya are likely to support oil this week.

Gold

It appears gold needs a full-blown out war in the Middle East or a complete collapse in trade talks to break out above $1,300 an ounce. The yellow metal is sliding, as US stocks attempt to rebound after returning from a three-day weekend. The strong dollar has been gold’s worst enemy and we will need to see a lot of economic stories reverse course for that trend to end.