The US futures and European markets are trading lower as investors aren’t buying the momentum from Wall Street. The US benchmark Indices closed strong on the back of the optimism that perhaps a trade deal can be done between the US and China. President Trump said yesterday that ideal is within reach and we are getting “closer and closer”. All of us have seen this film before, the president has given such false hopes before, and some argue, this is a typical Trump tactic to divert attention from the ongoing impeachment threat due to the result of the phone transcript between the US president and Ukrainian president.

The reality is that markets do want to see a trade deal between the US and China and no further tariff threats from the US. Every ray of light brings hope for investors and this results in stock markets moving higher; gold retracing from its recent highs and Treasury yields shooting up. To put things in perspective, the S&P 500 index closed higher with a gain of 0.62 percent and the Dow Jones soared 0.61 percent yesterday.

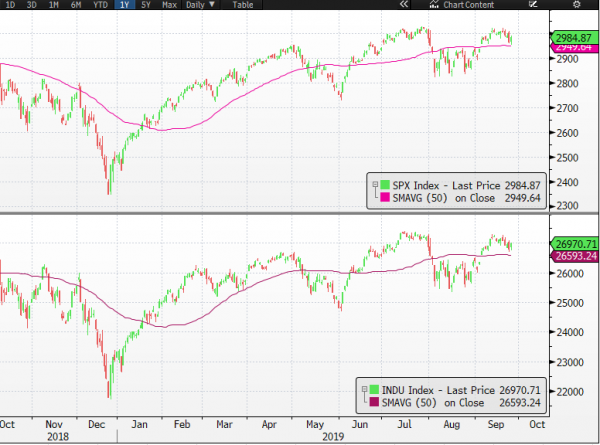

The 50-day SMA Is Providing The Lifeline For The Bulls

The most critical element with respect to the US indices is that pretty much all of them have bounced once again from their 50-day moving averages yesterday. Only time will tell if this particular moving average is supported by enough buyers.

The US futures and European markets are trading lower as investors aren’t buying the momentum from Wall Street. The US benchmark Indices closed strong on the back of the optimism that perhaps a trade deal can be done between the US and China. President Trump said yesterday that ideal is within reach and we are getting “closer and closer”. All of us have seen this film before, the president has given such false hopes before, and some argue, this is a typical Trump tactic to divert attention from the ongoing impeachment threat due to the result of the phone transcript between the US president and Ukrainian president.

The reality is that markets do want to see a trade deal between the US and China and no further tariff threats from the US. Every ray of light brings hope for investors and this results in stock markets moving higher; gold retracing from its recent highs and Treasury yields shooting up. To put things in perspective, the S&P 500 index closed higher with a gain of 0.62 percent and the Dow Jones soared 0.61 percent yesterday.

The 50-day SMA Is Providing The Lifeline For The Bulls

The most critical element with respect to the US indices is that pretty much all of them have bounced once again from their 50-day moving averages yesterday. Only time will tell if this particular moving average is supported by enough buyers.