For the 24 hours to 23:00 GMT, the EUR rose 0.07% against the USD and closed at 1.1022.

On the data front, Germany’s GfK consumer confidence index unexpectedly rose to a level of 9.7 in December, defying market expectations for a steady reading. In the prior month, the index had recorded a level of 9.6.

In the US, data showed that the housing price index advanced 0.6% on a monthly basis in September, surpassing market anticipations for a rise of 0.2%. In the prior month, the index had advanced 0.2%. Moreover, the nation’s advance goods trade deficit narrowed to a 17-month low level of $66.53 billion in October. In the prior month, the nation had posted a revised deficit of $70.55 billion in the prior month.

On the contrary, the US new home sales declined 0.7% on monthly basis to a level of 733.0K in October, less than market consensus for fall to a level of 709.0K. New home sales had registered a revised reading of 738.0K in the previous month. Also, the nation’s CB consumer confidence index dropped to a level of 125.5 in November, declining for the fourth consecutive month and following a revised level of 126.1 in the prior month. Moreover, the Richmond Fed manufacturing index fell to -1.00 in November, compared to a reading of 8.00 in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.1014, with the EUR trading 0.07% lower against the USD from yesterday’s close.

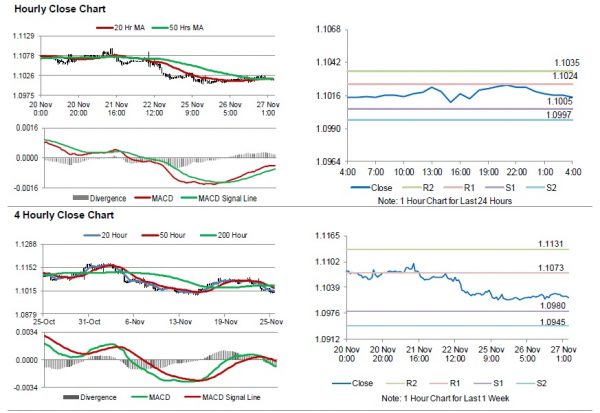

The pair is expected to find support at 1.1005, and a fall through could take it to the next support level of 1.0997. The pair is expected to find its first resistance at 1.1024, and a rise through could take it to the next resistance level of 1.1035.

Amid lack of macroeconomic releases in the Euro-zone today, traders would focus on the US annualised gross domestic product for 3Q 2019, durable goods orders and pending home sales, both for October along with the Chicago Purchasing Managers’ Index for November, set to release later in the day. Also, the MBA mortgage applications, initial jobless claims and the Fed’s Beige Book report, will be on traders’ radar.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.