The United States and China will finally put pen to paper on the hard-fought ‘phase one’ deal on January 15, ending months of trade uncertainty and hostilities. However, it will be too early for the ebb in trade tensions to have benefited China’s export-heavy economy in the fourth quarter and GDP numbers due out of the country will likely leave markets underwhelmed. It will be an important data week in the UK and US as well, with monthly industrial output, inflation and retail sales figures dominating the economic calendar.

Will China’s GDP growth hold above 6%?

After months of back and forth negotiations, US and China trade relations look set to enter a new chapter with the signing of the so called ‘phase one’ deal on Wednesday. China’s Vice-Premier Liu He is expected to travel to Washington for the signing ceremony. The low-key event should serve as a reminder to investors that relations between the two countries have not thawed substantially enough for Chinese President Xi Jinping to have attended the ceremony himself.

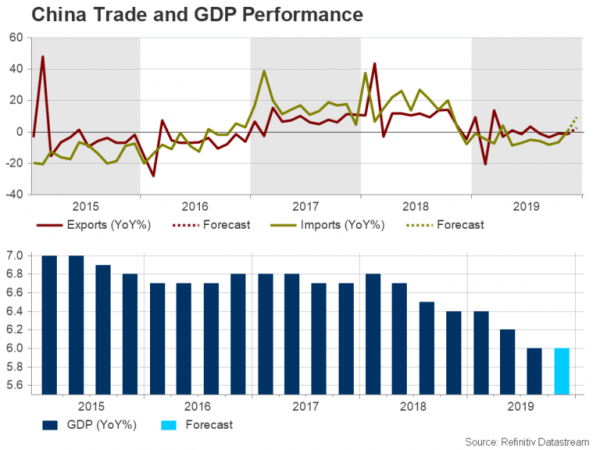

There’s also a risk that the highly anticipated finalization of the interim agreement may become overshadowed by less than inspiring economic indicators out of China. December trade stats are due on Tuesday and are expected to show a mild improvement in exports of 2.5% year-on-year growth. However, imports are forecast to have surged by 9.3% y/y – perhaps a possible sign that domestic demand bounced back towards the end of the year.

On Friday, market attention will be on the fourth quarter GDP print. The world’s second largest economy is projected to have expanded by 6.0% y/y, unchanged from the prior quarter. Although Chinese data rarely miss the forecasts by a large margin, a symbolic drop in annual growth below 6% would signify that the days of 7% plus growth are long gone and it will take more than a partial trade deal to turbo-charge the economy.

Investors will also be watching industrial output, urban investment and retail sales numbers for December on Friday for a more precise analysis of economic conditions at the turn of the year.

Assuming that the signing of the ‘phase one’ deal goes ahead as planned the data could boost or dent the current wave of risk appetite depending on whether they impress or disappoint. Global equities and the Australian dollar are likely to be the biggest movers from any surprises.

German preliminary 2019 GDP eyed

It will be somewhat of a muted week in the Eurozone next week with the only data capable of stirring the markets being the initial full year GDP estimate for 2019 for Germany. Despite some signs of stabilization in growth across the euro area, the threat of a German recession has not completely faded, and Europe’s largest economy may still take a turn for the worse if Trump decides to slap tariffs on European imports in the coming months.

The preliminary GDP reading, which should give an indication on Q4 growth, is due on Wednesday and Eurozone industrial production numbers are also released the same day. The Eurozone’s final inflation print for December will follow on Friday and the European Central Bank will publish the account of its December policy meeting on Thursday.

The euro, which appears to have lost some steam after rallying at the end of last year, could suffer further falls from any negative shocks in the German GDP data. But traders will also be looking out for possible clues on the policy outlook from the ECB minutes, having failed to read much about President Lagarde’s views from her first press conference.

Flurry of UK data unlikely to curtail rate cut speculation

A barrage of data out of the United Kingdom will flood the markets on Monday and for much of the rest of the week. Monday’s releases will be for November and so may be seen as somewhat out-of-date, though they will nevertheless lay bare the extent of the damage from the political chaos that crippled the country up until the December general election.

Starting with the monthly GDP estimates, the UK economy is forecast to have shrunk by 0.1% on a 3-months basis and to have recorded no growth month-on-month in November, suggesting Q4 growth could be negative unless there’s a positive contribution from December output. Industrial and manufacturing figures are not anticipated to be any better. Both industrial and manufacturing production are expected to have declined by 0.2% m/m. The trade balance for November is also out on Monday.

Moving to Wednesday and Friday, inflation and retail sales numbers are released for December, respectively. These will probably be watched closely by the Bank of England amid a growing dovish shift by policymakers. The retail sales report will be especially important in assessing whether consumption bounced back at Christmas after a poor showing in November.

Outgoing governor, Mark Carney, hinted this week that persistent weakness in the economy would warrant a “prompt response”, sending the pound plunging. Any disappointment therefore in next week’s data could trigger sharper falls in sterling.

Can US inflation and retail sales data extend the dollar’s rebound?

The US dollar has recovered from the six-month lows it brushed on the last trading day of 2019 as geopolitical tensions and a slight softening of the risk rally have helped the greenback claw back some of its end of year losses. Doubts about a speedy pick up in global growth and still relatively solid US fundamentals have supported the dollar in recent days. That trend may continue in the coming week if the positive economic picture remains intact.

The first major release is on Tuesday with the consumer price index (CPI) on December. The headline rate of CPI is expected to have edged up from 2.1% to 2.3% y/y in December, while the core rate is forecast to have held steady at 2.3%. Producer prices will follow on Wednesday, along with the New York Fed’s Empire State manufacturing index. The Philadelphia Fed will publish its manufacturing gauge on Thursday, but the real highlight that day will be the retail sales figures for December. Retail sales are expected to have increased by 0.4% over the month, accelerating slightly from the prior 0.2% rate. If confirmed, it would signal US consumers finished the year on a confident note.

Rounding up the week on Friday are building permits, housing starts and industrial production – all for December – as well as the preliminary reading of the University of Michigan’s consumer sentiment index for January.

The Federal Reserve has made it clear the bar for a rate hike is higher than that for a cut, while markets are pricing a more than 50% probability of a 25-basis-points rate reduction by the year end. This implies there is plenty of scope for the dollar to appreciate further if those rate-cut odds were to diminish.

Earnings season to get underway as geopolitical tensions ease

Another driver of the dollar over the next few weeks will be geopolitical tensions. The risk of an imminent military conflict between the US and Iran may have receded following the recent flare up, but it would be naive to rule out attempts by Iran-backed militias to attack American targets even though Iran has signalled it’s not planning any further retaliation against the US. A fresh escalation would hurt the dollar against the safe-haven yen and equities would lose out too.

Wall Street was quick to shrug off the worrying developments in the Middle East, but the Q4 earnings season may pose a bigger challenge for the US stock market rally given the economic weakness observed in the final three months of 2019. The focus next week will be on the banking sector, with the likes of JP Morgan, Citigroup and Wells Fargo expected to announce their earnings results.