U.S. Highlights

- The U.S. economy continued to churn out jobs at a solid pace. Non-farm employment grew by 1.6% over 2019, marking only a slight deceleration from the 1.7% recorded in 2018.

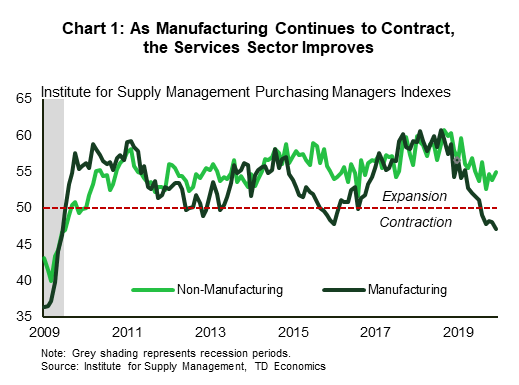

- The services side of the economy also continued to fare better than its manufacturing counterpart. The ISM Non-Manufacturing Index edged 1.1 points higher, to its highest level in seven months.

- The U.S. trade deficit dipped to its lowest level in three years as tariffs, among other factors, shifted trade flows.

Canadian Highlights

- Risk appetite returned to equity markets this week. Easing geopolitical risks pushed the TSX index to new record highs, even as domestic economic data released this week was not something to write home about.

- The trade deficit narrowed in November, the improvement, however, was not due to strong exports, but rather a result of imports falling more than exports. Housing starts also missed market expectations in December, dipping below 200k units for the first time since May.

- The much-anticipated December employment report revealed that the Canadian economy added a modest 35k new jobs, following two months of losses.

U.S. – Services Keep the Economic Engine Humming Along

The highly anticipated employment data revealed that the U.S. economy added jobs for the 10th consecutive year, despite a slower pace of hiring. Non-farm payrolls rose by 145k in December, a mild deceleration from November’s 256k. This gain was largely concentrated in the services sector, with job increases in retail trade (+41k), health care (+28k), leisure and hospitality (+40k) and construction (+20k). Manufacturing employment however was down by 12k. The unemployment rate continues to hover at its 50-year low of 3.5%, while year-on-year wage gains decelerated to 2.9% from 3.1% in November.

Despite the overall positive tenor of the report, there are warning signs on the horizon as the U.S. population in 2019 grew at the slowest pace in about a century. Though the economic impact of this development may be slow to materialize, it does have implications for the availability of workers, taxpayers and consumers to fuel future growth.

The employment numbers suggest that U.S. service sector activity has been resilient. This was echoed in sentiment, where the Institute for Supply Management’s Non-Manufacturing Index diverged from its manufacturing counterpart in December. The index edged 1.1 points higher to 55.0 – its highest level in seven months. Healthy consumer fundamentals and less exposure to trade tensions helped the services sector, which accounts for a larger proportion of the U.S. economy, remain in expansionary territory throughout 2019. This is in contrast to the manufacturing sector, where activity has been contracting for the past five months and in December slumped to its lowest level since June 2009 (Chart 1).

Geopolitical developments continued to influence market movements this week as Iran retaliated for the death of a top military leader, with an air strike against U.S. forces. Markets reacted violently to this development, with stock futures tumbling. However, by end-of-week stocks pared losses, and oil and gold retreated from earlier highs.

On the trade front, U.S. tariffs contributed to a slide in imports (down 1% month-on-month) in November while exports picked up (up 0.7% m/m), pushing the trade deficit to its lowest level since October 2016 (Chart 2). The goods and services deficit decreased by 8.2% to $43.1bn in November, down from $46.9bn in the previous month. Of note, the country’s merchandise trade deficit with China fell for a fourth consecutive month reflecting tensions between the two countries. A preliminary trade deal however, expected to be signed next week, should bring improvements in bilateral trade relations. Despite this, the impact of potential tariffs on goods from other trading partners such as the EU and Latin America cannot be discounted, and may result in further data distortions in the months ahead.

Overall, the U.S. economy has managed to exit a tumultuous 2019 relatively better-off than most other advanced economies. While U.S. growth is expected to slow in 2020 as detailed in our latest forecast, it will still lead the G7 pack, notwithstanding continued trade policy uncertainty.

Canada – Job Growth Returns in December

Risk appetite returned to equity markets this week amid easing geopolitical risks. The U.S. and Iran have backed away from a near-term military conflict. Trade tensions also receded somewhat, amid official confirmation that China’s Vice President Liu He will be arriving to Washington next week to sign a phase-one deal. These developments helped to push the TSX index to new record highs, even as domestic economic data released this week was not something to write home about. Incoming data was consistent with the notion that Canadian economic growth has slowed noticeably in the fourth quarter.

International trade data was the first on the docket, and revealed that the trade deficit narrowed in November. The improvement, however, was not due to strong exports (which actually contracted on the month), but rather a result of imports falling more than exports. Worse, in volume terms, which matter for GDP growth, exports fell sharply, outpacing the contraction in imports. Temporary factors appear to have been at play in November, with Statistics Canada noting that declines in exports and imports coincided with the CN Rail strike. The GM strike, which ended in late October, could have also muddied recent trade data. With both strikes now in the rear-view mirror, December trade data should look better. Even so, trade will likely remain a drag on economic growth in Q4, with a sub-1% GDP print looking like a distinct possibility.

Housing starts also missed market expectations in December, dipping below 200k units for the first time since May. Despite some moderation in the pace of construction relative to the earlier months of last year, a sharp downturn in homebuilding remains an unlikely scenario. Robust population growth, low mortgage rates, rising home prices and low rental vacancy rates in key metro markets are all factors supporting new home construction. Indeed, we forecast starts to edge only moderately lower in 2020 (Chart 1), as past declines in pre-construction sales weigh on homebuilding activity even as economic fundamentals remain solid.

Strong job and wage gains have been another factor supporting housing markets. The much-anticipated December employment report was released today. While the headline print was modest at 35k net new jobs, it was encouraging to see job growth return following two months of losses. The composition was favourable, with all the gains and then some in full-time work (+38.4k). The private sector broke its contractionary streak (+56.9k). A positive December print is reassuring, but there’s no denying that while the labour market started the year like a lion it ended like a lamb (Chart 2). After adding nearly 270k new jobs during the first two quarters of the year, job gains averaged just 25k in Q4.

Overall, this week’s data is consistent with Governor Poloz’s remarks yesterday where he noted the recent softening in the data flow, but did not spill any beans regarding the near-term monetary policy course. This is not overly surprising. Given the many one-off factors at work in Q4, the Bank of Canada is likely taking its time disentangling their impact. We’ll have to wait for this month’s Monetary Policy Report (January 22nd) to see where the Governor and his team land in interpreting these and other recent trends.

U.S: Upcoming Key Economic Releases

U.S. Consumer Price Index – December

Release Date: January 14, 2020

Previous: 0.3% m/m, 2.1% y/y

TD Forecast: 0.3% m/m, 2.4% y/y

Consensus: 0.2% m/m, 2.4% y/y

The headline CPI was probably boosted in December by higher gasoline prices—we forecast up 0.3% month-over-month. Moreover, gasoline prices were falling a year ago, so the 12-month change in the overall index is likely to pick up to 2.4% from 2.1%. We expect a more trend-like 0.2% month-over-month rise in the core index. The 12-month change in core probably held at 2.3%, although it is a close call between 2.3% and 2.4%. The 12-month change in core prices was 2.2% in December 2018, so there has been slight acceleration in the past year.

U.S. Retail Sales – December

Release Date: January 16th, 2020

Previous: 0.2% m/m

TD Forecast: 0.5% m/m

Consensus: 0.3% m/m

Seasonally adjusting retail sales can be challenging around year-end, but sales probably rose fairly solidly in December, even with a dip in auto sales. Anecdotal reports on the holiday shopping season were generally positive, albeit with department stores continuing to lose market share to nonstore retailers. The backdrop for spending has remained positive, with the labor market still fairly strong (even with some slowing in the payrolls data for December), wealth measures rising and consumer confidence staying high.

Canada: Upcoming Key Economic Releases

Bank of Canada Business Outlook Survey

Release Date: January 13th, 2020

The Bank of Canada’s Business Outlook Survey (BOS) will be watched for any signs of near-term malaise following the recent deterioration in economic data surprises and small business sentiment, which currently sits at the second lowest level since 2016. Despite recent softness in economic data, consensus GDP expectations have been revised higher in five of the last six months, which should lend support to expectations for sales growth. Elsewhere, the pickup in Q3 investment should translate into some relief in capacity-related indicators, and the recent moderation in employment data suggests an easing of labour shortages from the previous survey. Overall, this may result in a modest pullback for the aggregate BOS indicator, but we do not expect a retest of the Q1 lows. The Bank of Canada will also publish its Canadian Survey of Consumer Expectations alongside the BOS.