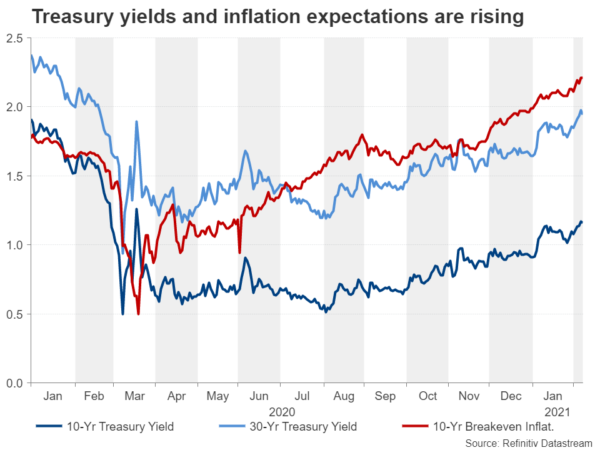

With so much talk of inflation lately, the monthly print of the consumer price index (CPI) out of the United States on Wednesday (13:30 GMT) might attract a bit more attention than usual. After the NFP disappointment, stronger-than-expected CPI data could be what the dollar needs to resume its uptrend. President Biden’s $1.9 trillion stimulus proposal has sparked fears that the colossal-sized package may stoke inflationary pressures. Former colleagues Treasury Secretary Janet Yellen and Fed Chair Jerome Powell have both played down the threat of higher inflation from big spending plans. But rising Treasury yields and measures of inflation expectations suggest otherwise.

Is inflation making a comeback?

The coronavirus pandemic dealt a severe blow to inflation, pushing price growth to or below zero almost everywhere around the world. However, although economic output remains depressed far below pre-pandemic levels in most countries, inflationary pressures seem to be picking up far quicker than anyone anticipated, raising some question marks about how loose monetary and fiscal stimulus can stay.

Expectations of a large virus relief package have revived the reflation trade whereby government bond yields and equities rise together as investors bet on the return of inflation but the abundance of liquidity keeps stocks buoyant.

The yield on 10-year Treasury notes hit an 11-month high on Monday, while the 30-year yield topped 2% for the first time in a year. More worryingly, a closely watched barometer of inflation expectations – the 10-year breakeven inflation rate – has soared to the highest since 2014 this week, climbing above 2.2%.

Stimulus floodgates wide open

Yet neither policymakers at the Treasury nor the Fed appear too concerned about this. If anything, their stance is that even more stimulus is needed. The Fed couldn’t be more vocal about calling for additional fiscal support from the federal government while pledging to continue pumping $120 billion a month into the US economy for as long as needed. As for the former Fed chief who is now running the Treasury Department, Yellen has perhaps been the biggest surprise in all this by championing Biden’s ambitious spending plans without much care about the threat of inflation.

Both Powell and Yellen are arguing that any spike in inflation is likely to be ‘transient’ and easy to contain should it get out of control, while the cost of doing too little could have significant long-term ramifications for the economy. However, they may be right to not be very concerned about fuelling inflation just yet.

US CPI is steadying, but for how long?

All measures of US inflation have steadied since the autumn after bouncing back quickly in the summer months from the lockdown dip. But there are risks. Core inflation did not fall as much as the headline figures did at the height of the virus crisis. Core CPI stands at 1.6% year-on-year and the Fed’s preferred core PCE price index was at 1.45% in December. So any surge in prices could easily bump them above the Fed’s 2% target.

Headline inflation is still quite subdued, with the CPI rate currently at 1.4%. But rising oil prices could soon change that. Another danger in the coming months is the possibility of a jump in inflation in the services sector. If America’s vaccination programme stays on track, allowing the reopening of closed-up retail, leisure and hospitality venues, the rush of fun-starved consumers to such places could push up the prices of those services quite substantially as businesses try to make up for lost trade.

But it’s not just in the services economy that policymakers may be overlooking the risks. Manufacturers continue to face spiralling costs from the supply disruptions caused by the pandemic, and it’s probably too early to predict whether the problems will be completely resolved once virus restrictions are gradually removed. Moreover, businesses are still adjusting to increased trade barriers from Brexit and the Sino-US trade war, which the Biden administration has no plans on ending.

Nevertheless, the near-term picture for inflation is quite tamed, meaning Powell and Yellen have no reason to change course. Headline CPI is expected to have edged up by 0.3% month-on-month and by 1.5% on a 12-month basis in January. Core inflation is forecast to have eased slightly to 1.5% y/y.

Dollar rebound suffers a setback

If the CPI numbers beat the forecasts, they could reinforce the view that inflation is on the rise, helping the US dollar to halt this week’s selloff. Dollar/yen was recently capped by its 200-day moving average (MA) and could have another attempt at overcoming it if positive momentum is restored. Above the 200-day MA, currently at 105.54, the 106 and 107 levels will be the next key resistance barriers to watch.

However, weaker-than-expected readings could accelerate the dollar’s decline amidst the risk-on backdrop, pulling dollar/yen towards its 50-day MA at 103.91. Sharper losses could see the pair retesting the 10-month low of 102.57 from early January.

Should the CPI report fail to provide much direction, traders might turn their attention to Powell who is due to speak at an online event organized by the Economic Club of New York later in the day at 19:00 GMT. Powell’s remarks will come under scrutiny after last week’s soft jobs report, but he is unlikely to stray from his most recent views.