The USD retreated further yesterday against a number of its counterparts, as inflation readings released yesterday tended to ease market worries. February’s US CPI rates accelerated somewhat yet did not outperform expectations easing market worries for inflationary pressures in the US economy somewhat. It should be noted that US yields declined further yesterday with the 10-year yield closing at 1.52%, also weakening the USD somewhat while further focus is expected to be placed on the 30-year treasury bond, about to be auctioned later today. On the fundamental side, it should be noted that Biden’s $1.9 trillion fiscal stimulus bill got its final approval by the House of Representatives removing substantial uncertainty for the US economic outlook. On the pandemic front, the US government announced that it will double the US order for a vaccine from Johnson & Johnson, confirming the rapid pace of vaccination in the US.

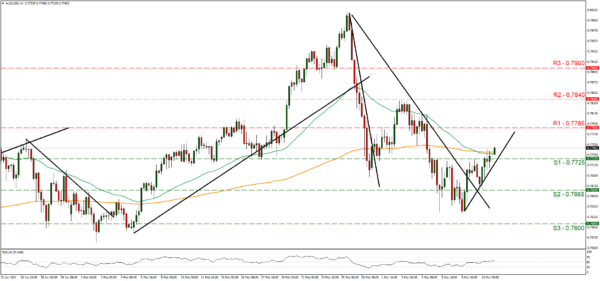

AUD/USD rose yesterday breaking the 0.7725 (S1) resistance line, now turned to support. We tend to keep our bullish outlook for the pair as long as it remains above the upward trendline formed by the price action since the 9th of March. Also note that the RSI indicator below our 4-hour chart is currently above the reading of 50 providing for a slight advantage for the bulls. Should the bulls actually maintain control over the pair, we may see it breaking the 0.7785 (R1) resistance line and aim for the 0.7840 (R2) resistance level, which capped the pair’s ascent on the 3rd of March, while even higher we have noted the 0.7900 (R3) resistance barrier. Should the bears be in charge, we may see AUD/USD breaking the 0.7725 (S1) support line and aim for the 0.7665 (S2) support level that prevented any further losses on the 10th of March reaffirming our upward trendline. Even lower we note the 0.7600 (S3) support hurdle that kept the pair afloat early February.

ECB to remain on hold

ECB is expected to remain on hold today during the late European session (12:45, GMT), keeping the deposit rate at -0.50% and the refinancing rate at 0.0%. Currently EUR OIS imply a probability of 95.6% for such a scenario to materialize. On the other hand, the bank is expected to add another €500 billion to its PEPP program by a number of analysts, albeit that remains highly uncertain from our perspective. Also, the bank is expected to release a new set of forecasts, probably revised slightly to the downside. Probably ECB’s President Lagarde may have to face questions in her press conference (13:30, GMT) about the rising yields and the bank’s intentions about the issue. Fundamentally the slow pace of vaccination still clouds the economic outlook of the zone. Overall, the bank is expected to maintain a dovish tone and we see risks related to the event as tilted to the bearish side for EUR. Please note that volatility for EUR pairs could be extended throughout Lagarde’s press conference.

EUR/USD rose yesterday and broke the 1.1905 (S1) resistance line, now turned to support. As the pair broke also the downward trendline characterizing its movement since the 25th of February, we switch our bearish outlook in favour of a sideways bias initially, yet the bulls may be just around the corner. It should be noted that the RSI indicator below our 4-hour chart is at the reading of 50 implying a rather indecisive market for now. Should the pair find fresh buying orders along its path we may see it breaking the 1.1990 (R1) line and aim for the 1.2100 (R2) level, which capped the pair’s ascent on the 3rd of March. On an ultimate bullish scenario, we may see EUR/USD aiming for the 1.2810 (R3) resistance level. Should a selling interest be displayed we may see EUR/USD breaking the 1.1905 (S1) support line aiming for the 1.1830 (S2) line which held its ground on the 8th of March, while even lower we note the 1.1760 (S3) support level.

Other economic highlights today and early Tuesday:

Today in the American session we note the weekly initial jobless claims figure and the Jolts job openings for January, while later on we get New Zealand’s manufacturing PMI. Please note that UK’s finance minister Rishi Sunak is scheduled to speak before the house of commons.

Support: 0.7725 (S1), 0.7665 (S2), 0.7600 (S3)

Resistance: 0.7785 (R1), 0.7840 (R2), 0.7900 (R3)

Support: 1.1905 (S1), 1.1830 (S2), 1.1760 (S3)

Resistance: 1.1990 (R1), 1.2100 (R2), 1.2180 (R3)