The USD strengthened yesterday also supported by a rise in US Treasury yields after the release of the US CPI rates for April which outperformed market expectations and increased worries for inflationary pressures. On the other hand, it should be noted that US Stockmarkets tumbled as all three major indices, Dow Jones, S&P 500 and Nasdaq tumbled while gold prices couldn’t resist the strengthening of the USD and dropped as well. The US CPI rates tended to accelerate the most in 12 years on a month on month level, as demand for goods is high as the economy recovers. Overall, the high inflation rates are expected to increase the pressure on the Fed to start tapering its QE program in an effort to start tightening its otherwise ultra-loose monetary policy, yet the Fed’s policymakers seem to remain rather dovish. The greenback could strengthen further in the aftermath of the release given also that the market may have to reposition itself, after the bearish bets that proceeded the release since Monday. Attention is expected to turn to the US weekly initial jobless claims figure which gains on importance after the disappointing NFP release for April on Friday as well as April’s US inflation measures for producers, both due out in the American session.

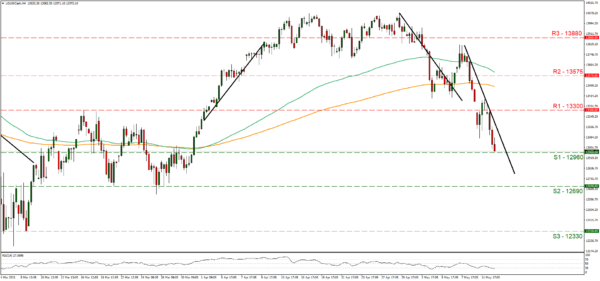

Nasdaq dropped yesterday breaking the 13300 (R1) support line now turned to resistance and near the end of the session was testing the 12960 (S1) support line. We maintain a bearish outlook for the index as long as it remains below the downward trendline incepted since the 7th of May. Please note that the RSI indicator below our 4-hour chart is at the reading of 30, which on the one hand confirms the bear’s dominance, yet on the other may imply that the index is oversold and a correction higher is possible. Should the bears actually maintain control over the index’s direction, we may see Nasdaq breaking the 12960 (S1) support line and aim for the 12690 (S2) support level which reversed the index’s downward motion on the 19th and 25th of March. Should the bulls take over, we may see the index breaking the prementioned downward trendline and aim if not break the 13300 (R1) resistance line.

Aussie reaches 1 week low against USD

AUD reached a one week low against the USD during today’s Asian session, as the greenback tended to gain from the better than expected US inflation rates of April. In Australia, inflation is expected to remain under RBA’s 2-3% target band for a long time to come, and that despite the healthy economic recovery. It’s characteristic that RBA last week had underscored that the economy was well short of full employment conditions and that wage growth is low. So, the prospect of widened interest rate differential between the two currencies tend to weigh currently on the AUD side. On the other hand, it should be noted that the tensions in the US-Sino relationships remain at high levels, another factor weakening the AUD, while prices for commodities such as iron ore and copper tend to support the Aussie as they are at rather high levels.

AUD/USD dropped yesterday breaking clearly the 0.7785 (R2) support line and is currently hovering just below the 0.7725 (R1) support line, with both levels now turned to resistance. We tend to maintain a bearish outlook for the pair, yet some stabilisation around the 0.7725 line seems to be taking place since today’s Asian session. Please note that the RSI reading below our 4-hour chart is just above the reading of 30 also providing an advantage for the bears. Should the selling interest be renewed for AUD/USD, we may see the pair aiming if not breaking the 0.7665 (S1) line. Should the pair find extensive buying orders along its path, we may see AUD/USD breaking the 0.7725 (R1) line and aim if not breach the 0.7785 (R2) level.

Other economic highlights today and the following Asian session:

Today we highlight the release of the US weekly initial jobless claims figure as well as the PPI rates for April. As for speakers please note BoC Governor Macklem, BoE Governor Bailey and Richmond Fed President Barkin are scheduled to speak later today.

Support: 12960 (S1), 12690 (S2), 12330 (S3)

Resistance: 13300 (R1), 13575 (R2), 13880 (R3)

Support: 0.7665 (S1), 0.7595 (S2), 0.7530 (S3)

Resistance: 0.7725 (R1), 0.7785 (R2), 0.7860 (R3)