It will be a busy week as the Bank of Canada, Bank of Japan and the Reserve Bank of New Zealand all meet, while inflation will take centre stage on the data front. With increasing concerns that the new Delta Covid variant could scupper reopening plans around the world, Japanese policymakers are the most likely to strike a more cautious tone, but the BoC and RBNZ will probably maintain their optimism for now. After the Federal Reserve signalled that a taper decision was not imminent, markets might take a more relaxed view on the latest CPI readings in the United States. Meanwhile, Q2 GDP numbers will be watched in China for signs that the recovery in the world’s second largest economy may be plateauing.

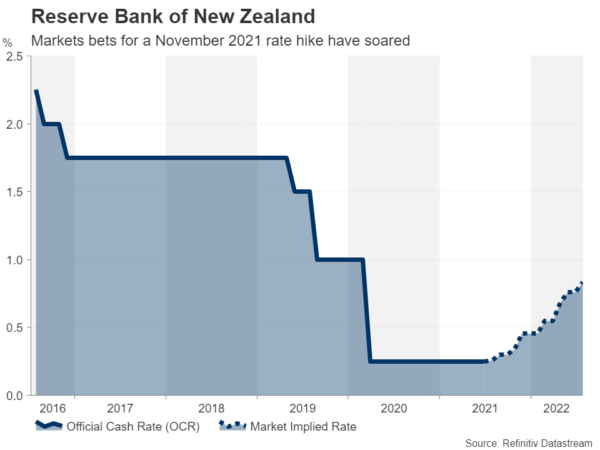

Will RBNZ add fuel to November rate hike calls?

There’s been a sudden shift in RBNZ rate hike expectations over the past week after a closely watched business confidence gauge jumped to the highest in four years in Q2. The survey was the latest to point to improving sentiment across New Zealand as the country appears to be coming out of the pandemic hole much quicker than other advanced economies. Subsequently, market participants have brought forward the timing of how soon the RBNZ will hike rates, pricing in a near two-thirds possibility of higher rates by November 2021 compared to earlier predictions of August 2022.

For the July meeting, however, the RBNZ is almost certain to keep its policy settings on hold when it meets on Wednesday. Nevertheless, investors will be scrutinizing the language in the statement as upbeat remarks about the economy would reinforce expectations that a rate hike is likely to come sooner rather than later. Although it can’t be ruled out that policymakers might emphasize that the outlook has become less certain following the spike in infections in the region, the likelihood is very slim given that New Zealand has so far avoided a major outbreak of the Delta variant.

The New Zealand dollar could receive a short-term boost against its US counterpart if the RBNZ does not say anything that puts into question the revised timeline for rate hikes. However, the fact that even after such a dramatic move in rate hike bets, the kiwi was unable to reclaim the front foot against the greenback, global risk sentiment and Fed taper speculation seem to be bigger priorities for investors right now.

Ahead of the RBNZ decision, electronic card retail sales for June might attract some attention on Monday and the consumer price index for the second quarter will be important too on Friday.

China’s recovery may be cooling

China will report GDP numbers for the second quarter on Thursday and the data may add to the current jitters about a weakening growth outlook if they are worse than what is being anticipated. The Chinese economy grew by a staggering 18.3% year-on-year in the first three months of the year. However, the figure was inflated due to the low base effect of the prior year when GDP had slumped during the Q1 2020 lockdown. Moreover, recent PMI prints have been somewhat on the soft side. The forecast for Q2 is GDP growth of 8% y/y.

The monthly readings for industrial production and retail sales are also due on Thursday, which will be preceded by June trade figures on Tuesday. Should the barrage of data not do much in terms of shoring up confidence about the growth picture, especially as the rampant spread of the Delta variant is forcing fresh shutdowns in many parts of the world, market sentiment might take a hit. This could weigh on risk assets such as stocks, as well as hurt the China-sensitive Australian dollar.

Thursday could turn out to be a volatile session for the aussie as Australian employment numbers are on the agenda too. The recent lockdowns announced in Australia probably came too late to have a strong impact on the June jobs data, so the 30k rise in employment that is being forecasted for the month might be of some comfort for the local dollar.

BoC unlikely to be deterred by virus fears

The Bank of Canada will announce its policy decision hours after the RBNZ on Wednesday. A further reduction in QE is expected, with policymakers slowing the pace of bond purchases from C$3 billion to C$2 billion a week. The Bank will also publish updated economic projections and could reveal whether it is still pencilling in a rate increase for the second half of 2022.

Back in April, policymakers formally set an exit course out of the pandemic stimulus and although since then, a new threat has emerged in the form of the Delta variant, daily infections in Canada remain very low so there’s not much chance of the Bank turning more cautious. If anything, policymakers could reaffirm their optimism following the BoC’s rosy business outlook survey released just this week.

Even so, the Canadian dollar could continue to struggle versus the mighty US dollar amid the ongoing concerns about the strength of the global recovery, which have boosted demand for safe havens.

BoJ gloom to reflect Japan’s Olympic and virus woes

The Bank of Japan will not have as much to cheer about when it concludes its two-day policy meeting on Friday. The BoJ looks set to lower its growth projections for the current fiscal year when it releases its quarterly outlook report alongside its policy decision, which is expected to remain unchanged. Many regions in Japan are only now coming out of weeks of state of emergencies that were imposed to fight the country’s fourth virus wave. However, the capital Tokyo has been placed back under restrictions to prevent another surge when the Olympic Games start later in July. Thus, after an initial strong rebound, Japan’s road to recovery has unexpectedly become very bumpy.

What this all means for monetary policy is that the Bank of Japan is nowhere near normalizing policy, and it’s left little doubt that the BoJ will be engaged in QE long after other central banks have exited theirs.

But will a gloomier BoJ matter much for FX markets? That will all depend on whether risk appetite has bounced back by then. At the moment, the yen is enjoying a mini revival on the back of the worries about the Delta variant and broader doubts about economic growth. Should those jitters subside, the yen could come under renewed pressure. Though, until global bond yields end their slump, the Japanese currency could stay substantially elevated from its 2021 lows.

US CPI may not set markets alight but retail sales might

Over in the US, the main highlights will be the CPI report for June on Tuesday and retail sales figures on Friday. The month-on-month CPI rate could ease further in June, with forecasts pointing to a 0.4% increase, which would be down from the prior month’s rate of 0.6% and 0.8% in April. The annual rate is also forecast to moderate to 4.9% compared to May’s 13-year high of 5.0%.

However, with the surge in inflation having so far failed to alarm the Fed enough to press the brakes on stimulus, the June readings probably won’t either, especially after the minutes of the June FOMC meeting indicated policymakers have yet to see sufficient progress towards their goals that would warrant bringing forward a decision on tapering. What could, though, shift Fed expectations slightly are June’s retail sales prints.

Retail sales dipped 1.3% m/m in May as the boosts from the stimulus payments and reopening of the economy waned somewhat. Analysts are not anticipating a rebound for June and another disappointing month would support the case for FOMC members to be “patient” before announcing changes to the pace of asset purchases. However, a stronger-than-expected number could sway the odds in favour of earlier tapering, potentially giving the bullish dollar another leg up.

In other US releases, the producer price index will follow on Wednesday and traders will additionally be able to sift through manufacturing surveys (Empire State on Thursday and Philly Fed on Friday), industrial production data (Thursday) and the University of Michigan’s preliminary consumer sentiment gauge.

Finally, inflation figures are also due in the United Kingdom on Wednesday, to be followed by the latest jobless figures on Thursday. In the Eurozone, the final estimates of June inflation are out on Friday. Both the euro and pound are likely to continue taking their cues from the dollar over the coming days, with investors keeping an eye on infection rates in the UK and on the continent to see whether vaccines alone will be able to keep hospitalizations low as virus restrictions are loosened.