The Australian dollar has started the week on a positive footing, ending a five-session losing streak. As the market turmoil from the Delta variant eases somewhat, there might be additional support in store for the aussie from the upcoming economic releases for the second quarter over the coming days. However, investors are unlikely to be able to hide away from all the gloom for too long as Australia’s lockdowns look set to last for some time.

RBA tapering not derailed by lockdowns…yet

It will be a busy end to August and an anxious start to September in Australia as a raft of Q2 indicators are on the way. Not so long ago, the data might have been seen as holding some significance for the Reserve Bank of Australia’s forthcoming policy meeting on September 7. However, following the dramatic worsening of the virus situation, the data are now almost certainly outdated.

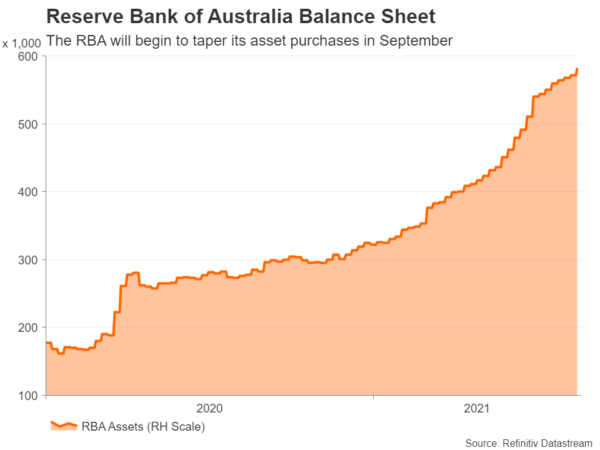

At its August meeting, the RBA had signalled it won’t be putting its tapering plans on hold even as the Delta outbreak unfolded and will go ahead and reduce its bond purchases to A$4 billion a week in September. But the minutes of that meeting published last week were slightly less hawkish than the statement, suggesting that further tapering in November when the QE pace will next be reviewed is looking less likely.

Vaccines seen as best hope of beating Delta variant

The way things are headed right now, policymakers could even ramp their bond purchases back up again in November. Australia’s prime minister, Scott Morrison, made it clear on Monday that lockdowns won’t be eased until the country’s vaccination rate reaches 70%. With just over 50% currently having received at least one dose, it could take several more weeks if not months before hitting that target, dampening the prospect of a strong economic rebound in Q4.

Nevertheless, with policymakers mostly relying on business surveys for up-to-date readings on the economy and the hard data so far not being particularly dire, the Q2 numbers might help stave off a notable dovish tilt at the September meeting. In the July jobs report, employment rose slightly, defying expectations for a large drop.

Flurry of Q2 data on the way but will they matter?

There’s not likely to be much evidence of lockdowns hurting the economy in Thursday’s data either. Capital expenditure figures due at 01:30 GMT are expected to show business spending growing by 2.5% during the second quarter, levelling off from a post-pandemic surge of 6.3% in the previous period. The following Tuesday, attention will turn to net exports contribution before the Q2 GDP print comes out on Wednesday, September 1.

Australia’s economy is projected to have expanded by 0.7% quarter-on-quarter in the three months to June. While this wouldn’t be as strong as in prior quarters when the economy was still recovering from the 2020 lockdowns, it’s a solid rate by pre-pandemic standards. If growth surprises to the upside, this might help the RBA buy some time before being forced to make a complete U-turn on its tapering plans.

Aussie bounces back but downside risks persist

It could also provide some much needed support to aussie/dollar, which plummeted to a 9½-month low of $0.7104 last Friday. The pair is currently testing the 78.6% Fibonacci retracement of the November 2020 – February 2021 upleg at $0.7208. A convincing break above it would turn the spotlight on the highly congested region of the 61.8% Fibonacci of $0.7378.

However, steeper gains would be difficult unless the virus picture improves substantially, or the US dollar suffers a major wobble of its own. Otherwise, it could only be a matter of time before the aussie slips below the $0.71 level, risking a revisit of the November trough of $0.6990.