The latest employment numbers out of the UK will hit the markets on Tuesday and Wednesday will see the release of the monthly GDP readings. Both are due at 06:00 GMT. Following the growing political and economic uncertainty of recent weeks, the question investors are asking is no longer about whether or not there will be a recession, but rather, how deep will it be. Yet, with so much gloom already priced in, can the pound enjoy a small boost if the data actually impress?

Truss knocks investors’ confidence in UK economy

It’s been a turbulent few weeks for the British economy as new Prime Minister Liz Truss has had a terrible start to her premiership. Her energy package was overshadowed by the Queen’s death and her chancellor’s mini budget sparked a global market panic instead of shoring up investor confidence as hoped. But even before those events, the pound had been on shaky ground as the months of political turmoil leading up to Boris Johnson’s ousting had investors worried about who was steering the ship whilst the cost-of-living crisis was unfolding.

However, even after some calm was restored and the government had to do a rethink on some of the policies it announced in the budget, there is a lot of angst about the direction Truss is taking the country. Reports suggest that some of the savings Chancellor Kwasi Kwarteng wants to achieve to help pay for the controversial big tax cuts are by raising benefits below the rate of inflation. This would mean a cut in real terms for those relying on benefits as their main source of income and is something that is causing divisions within the Conservative party.

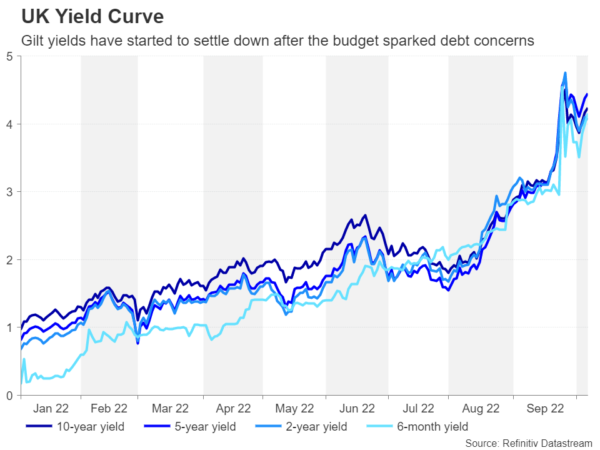

Truss’s decision to block a nationwide campaign on energy saving that was intended to reduce demand ahead of the winter has also raised eyebrows about her judgement. With Kwarteng not expected to reveal more details about how the government will manage the UK’s soaring national debt until October 31 and the Federal Reserve in America maintaining its ultra-hawkish policy stance, there’s not a lot of love going in the pound’s direction lately.

On the verge of a recession

Having said all that, the recent economic data haven’t been as bad as some of the headlines would imply. Most notably, the GDP estimate for the second quarter was revised up from the initial reading of -0.1% q/q to +0.2%, easing fears that the economy was already in recession. However, there’s still a high probability that the UK will enter a recession in the fourth quarter as the economy is expected to contract in the current quarter. After expanding by 0.2% m/m in July, GDP is forecast to have been flat in August, Wednesday’s data will likely show. The September figure is almost certain to be worse, however, due to the country coming to a standstill for the Queen’s funeral.

One bright spot has been the tight labour market, but even that could be losing steam as there are some signs that hiring has slowed in recent weeks. Employment is projected to have fallen by a whopping 155k in the three months to August in Tuesday’s report, following a gain of 40k in the prior three months. The unemployment rate, though, is expected to stay unchanged at 3.6%. Interestingly, growth in average weekly earnings is forecast to accelerate from 5.5% to 5.9% y/y, underscoring the fact that some of the slowdown in hiring could be attributed to the lack of available workers.

Pound is under pressure again

The pound has gotten off the new week on the backfoot, slipping below the 38.2% Fibonacci retracement level of $1.1112 of the September-August down selloff. After originally acting as support, the 38.2% Fibonacci has turned into an immediate resistance level. Any positive surprise in this week’s releases could help cable recover above it. But there are plenty of obstacles. The 20-day moving average (MA) stands at $1.1205, the 50% Fibonacci is at $1.1338, and the 50-day MA is approaching the 61.8% Fibonacci at $1.1563. Any short-term bounce is unlikely to have enough strength to overcome the 50-day MA, at least not before Kwarteng’s fiscal plan at the end of the month.

In the meantime, if the current slide picks up further negative momentum, the 23.6% Fibonacci of $1.0833 is the only thing standing in the way of the all-time low of $1.0382.

The Bank of England’s emergency bond-buying scheme, which was launched to calm the gilt market following the budget whiplash, put a floor under sterling’s slide. But the daily operations will cease at the end of the week, increasing the risk of a return to volatility in both the bond and currency markets from any worrisome headlines about the economy.