After selling the pound due to the slowdown in the UK CPIs for January, traders are now turning their attention to the preliminary PMIs for February, to be released on Tuesday at 07:30 GMT. With the BoE now trailing both the Fed and the ECB in terms of rate hike expectations, can the PMIs come to the pound’s rescue?

Inflation slowdown confirms BoE’s guidance change

At its last meeting, the BoE decided to raise interest rates by 50bps as was broadly expected, but there was a change in the forward guidance, with officials noting that further tightening would be required if there is evidence of more persistent price pressures. In previous statements, they were stating that they “would respond forcefully as needed”.

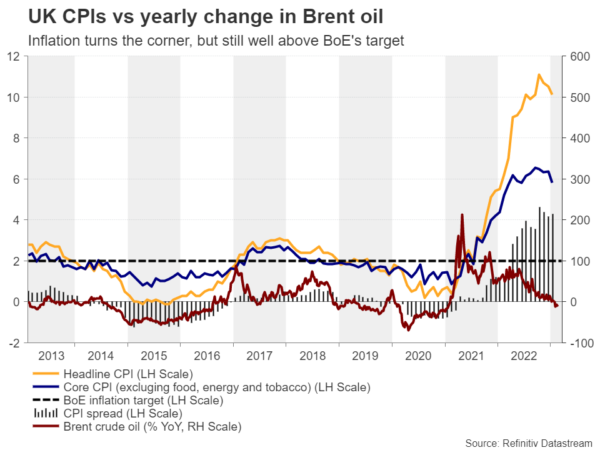

Governor Bailey made it clear that the change reflected a turning of the corner in the fight against inflation, and he was proven right just last Wednesday, when the UK CPIs for January were released. Both the headline and core rates fell to 10.1% y/y and 5.8% y/y from 10.5% and 6.3% respectively, below estimates of 10.3% and 6.2%. Although headline inflation is still in double digits, the slide in the core rate may have bolstered expectations that the BoE is nearing the exit of this tightening campaign.

Investors are currently assigning around a 75% probability for a 25bps hike at the upcoming meeting, with the remaining 25% pointing to no action. As for thereafter, they see only one more quarter-point increment before the Bank presses the stop button.

Economic risks are far from vanished

The British economy showed zero economic growth in the last three months of 2022 after contracting 0.2% q/q in Q3, just enough to dodge a recession. That said, the composite PMI slid further below 50 in January, which suggests that although the risks of a sharp recession in the UK have lessened, they are far from vanished. What makes things worse is that inflation for food and non-alcoholic drinks slowed to just 16.7% from a 45-year record of 16.8%, which means that households are still experiencing a severe cost-of-living squeeze. Average earnings excluding bonuses accelerated to 6.7% in December, but this was during a period when headline inflation was at 10.5%, leaving real wage growth well into the negative territory.

On Tuesday, the preliminary PMIs for February are expected to improve but to stay in contractionary territory. Specifically, the manufacturing index is expected to increase to 47.4 from 47.0, while the services index is anticipated to rise to 49.2 from 48.7. This would take the composite PMI up to 48.7 from 48.5. Ergo, another round of below-50 numbers could increase the chances of negative economic growth during the first quarter of 2023. Indeed, the GDP tracker of the National Institute of Economic and Social Research (NIESR) is currently pointing to a 0.2% contraction.

So, how fast or slow the Bank needs to move hereafter has no straightforward answer. On the one hand, they must keep raising interest rates to bring sky-high inflation to heel, but on the other hand, they must be careful enough to not bring about deeper economic wounds. So, even if they improve, the February PMIs could confirm the notion that the BoE may need to proceed much less aggressively than the Fed and the ECB.

Pound’s path of least resistance remains to the downside

The pound could initially rebound somewhat on the improving figures, but should investors maintain bets for only a couple more quarter-point increases, the British currency may be sold again. Pound/dollar could fall below the 1.1900 zone, which has been acting as key support since November 30. This could pave the way towards the 1.1645 barrier, marked by the inside swing high of October 27. If there are no buyers to be found there either, the slide may extend towards the low of November 4, at 1.1350.

Now, if future data suggests that inflation is stickier than previously expected and at the same time, the economy is in a better-than-feared shape, the pair could rise to the 1.2440 area. Nonetheless, a break above that zone may be needed for the outlook to turn overly positive again. Such a move would confirm a higher high and could initially target the 1.2670 area, defined as resistance by the high of May 27. If the bulls are strong enough to overcome that hurdle as well, they might then climb towards the 1.2975 territory, which provided support back in March and April 2022 before being broken on April 22.