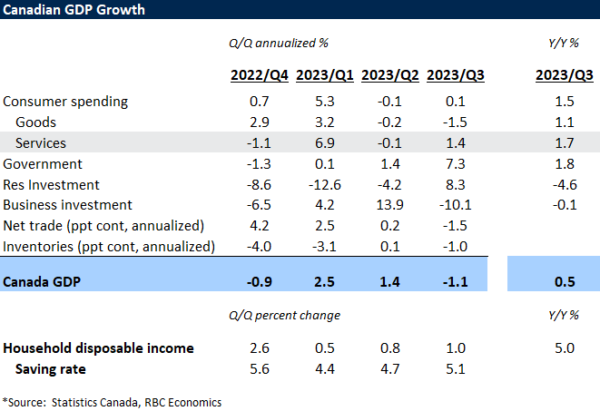

The pull-back in GDP in Q3 (-1.1% annualized) was substantially softer than expected, although following an upwardly revised 1.4% gain (previously -0.2%) in Q2.

Still, the details of the Q3 data were soft – GDP would have declined a larger 3% in the quarter without a 7.3% jump in government spending.

Business investment pulled back 10%, led by a drop in equipment purchases. And consumer spending was essentially unchanged for a second consecutive quarter.

With population growing rapidly, per-capita growth rates continue to look substantially softer – GDP per-capita declined for a fifth straight quarter in Q3, consistent with a drift higher in the unemployment rate since the spring.

Household purchasing power held up well, rising 1% from Q2, in part due to higher government transfers. But a smaller share of that income is being spent with the household saving rate edging up for a second straight quarter. And softer labour markets mean income growth is expected to slow going forward.

Early data for Q4 has been mixed. GDP edged up 0.1% in September (slightly stronger than expected) and the advance estimate for October was +0.2%. Those early estimates have been exceptionally revision-prone, and should be taken with a large grain of salt.

Output in the manufacturing sector fell almost 5% (annualized in Q3), and the retail and hospitality sectors also pulled back alongside soft consumer spending.

Bottom line: A revision to Q2 output prevented the Q3 drop from counting as a ‘second consecutive decline’. But the macro backdrop continues to look soft, particularly controlling for high levels of population growth that are boosting both the production capacity of the economy and the number of consumers. Labour markets have also looked softer – job vacancies separately reported this morning fell another 6% in September and are down more than 30% from a year ago. We expect the BoC to remain on hold for now with inflation still running above target – but our own forecast assumes the central bank will pivot to rate cuts starting to soften into next year.