Summary

As was widely expected, the FOMC left the fed funds target range unchanged at 5.25%-5.50% at the conclusion of its May meeting. It was evident, however, that the Committee believes inflation’s return to its 2% objective likely has a somewhat longer and uncertain journey ahead. In the post-meeting statement, the Committee noted that “in recent months, there has been a lack of further progress” toward its 2% inflation goal. This setback in obtaining confidence that inflation is on a sustainable path back to 2% reinforces our view that any reduction to the fed funds rate remains at least a couple of meetings away.

The Committee announced that it will slow the pace of quantitative tightening (QT) starting on June 1. The monthly cap for Treasury security redemptions was reduced from $60 billion to $25 billion, while the monthly redemption cap for mortgage-backed securities (MBS) was left unchanged at $35 billion. The slow-but-don’t-stop approach to balance sheet runoff is an attempt to keep normalizing the size of the Fed’s balance sheet without creating money market stresses like the ones that occurred in September 2019. The move to a slower pace of QT was well-telegraphed by the Committee, and the outlook for the federal funds rate will be far more critical to determining the level and shape of the yield curve in the months ahead, in our view.

Lack of Progress on Inflation Keeps FOMC on Hold

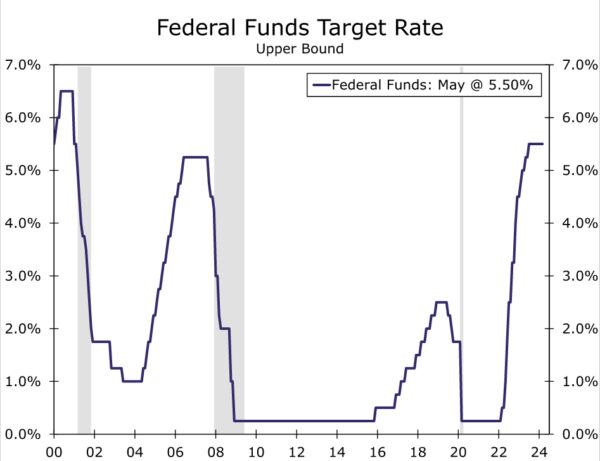

As universally expected, the Federal Open Market Committee (FOMC) voted unanimously at its meeting today to leave the target range for the federal funds rate unchanged at 5.25%-5.50%, where it has been maintained since last July (Figure 1). As is typical for the April/May FOMC meeting, the Committee did not release a Summary of Economic Projections, which contains the so-called “dot plot,” at the conclusion of this meeting. Therefore, market participants need to infer the FOMC’s intentions from its post-meeting statement and from the Q&A session in Chair Powell’s press conference. In our view, these data points suggest the Committee is not in any rush to cut rates, a message that was delivered by numerous Fed officials in the weeks leading up to today’s meeting (see our recent “Flashlight” report for further discussion.)

In that regard, the FOMC continues to have an upbeat assessment of the real economy. The post-meeting statement noted once again that “economic activity has continued to expand at a solid pace,” that “job gains have remained strong” and that “the unemployment rate has remained low.” Furthermore, the Committee continues to acknowledge that “inflation has eased over the past year,” although the statement noted for the first time that “there has been a lack of further progress toward the Committee’s 2 percent inflation objective.” As shown in Figure 2, the year-over-year rate of core PCE inflation, which the FOMC considers to be the best measure of the underlying rate of consumer price inflation, has receded from more than 5% in 2022 to 2.8% in March. However, core PCE prices have shot up at an annualized rate of 4.4% over the past three months. To paraphrase recent Fed speakers, the FOMC will need greater “confidence” that inflation is returning to 2% on a sustained basis before it feels comfortable cutting its target range for the federal funds rate. In our view, the Committee will not have that confidence until the September 18 FOMC meeting, at the earliest.

In Chair Powell’s post-meeting press conference, he noted that it likely will take longer than originally thought to get that confidence. Notably, he backed off any reference to the potential timing of a rate reduction in his prepared remarks, no longer stating that “it will likely be appropriate to begin dialing back policy restraint at some point this year” (emphasis ours). Yet he also noted that he believes it is “unlikely” that the FOMC will need to hike again and that policy remains restrictive. On balance, the recent data appear to have pushed the FOMC away from the precipice of rate cuts but still very comfortable with a wait and see approach.

Slow-But-Don’t-Stop for QT

Although the Committee kept its primary policy tool, the federal funds rate, unchanged at today’s meeting, the FOMC did announce some changes to its balance sheet runoff program. The Committee announced that it intends to slow the decline in its securities holdings by reducing the monthly redemption cap on Treasury securities from $60 billion to $25 billion. The monthly redemption cap for mortgage-backed securities (MBS) was left unchanged at $35 billion. The new caps will be effective starting June 1.

The logic for slowing runoff is fairly straightforward: the ultimate “equilibrium” size of the Fed’s balance sheet is uncertain, and a prudent risk management policy calls for a slow-but-don’t-stop approach as the Fed feels out the optimal size for its balance sheet. The minutes from the last FOMC meeting noted that “slower runoff would give the Committee more time to assess market conditions as the balance sheet continues to shrink.” Powell reiterated in his press conference that slowing the pace of runoff will help ensure a “smooth transition” and “reduce the possibility that money markets experience stress.” We think the new pace of runoff will continue through at least year-end 2024.