Key Highlights

- The US Dollar traded above the 111.00 level recently before correcting lower against the Japanese Yen.

- There is a key connecting bullish trend line in place with support at 109.90 on the 4-hours chart of USD/JPY.

- The US ADP Employment Change in June 2018 posted 177K, less than the forecast of 190K.

- Today in the US, the Nonfarm Payrolls figure for June 2018 will be released, which is forecasted to register 195K.

USDJPY Technical Analysis

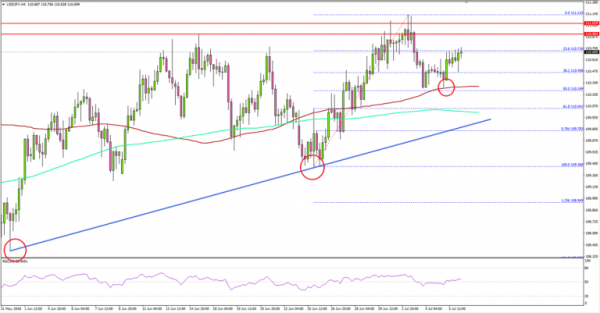

The US Dollar formed a short-term top near the 111.15 level against the Japanese Yen. The USD/JPY pair corrected lower, but it remains well supported above the 110.00 level.

Looking at the 4-hours chart, the pair formed a high at 111.13 and declined below the 110.80 and 110.50 support levels. There was also a break below the 38.2% Fib retracement level of the last wave from the 109.36 low to 111.13 high.

However, the downside move was protected by the 110.25 level and the 100 simple moving average (red, 4-hours). Moreover, the 50% Fib retracement level of the last wave from the 109.36 low to 111.13 high also played its part very well.

Further to the downside, there is a key connecting bullish trend line in place with support at 109.90 on the same chart, which is just below the 200 simple moving average (green, 4-hours).

Therefore, any major dips from the current levels are likely to find support near the 110.20, 110.00 and 109.90 levels. On the upside, the main hurdles for buyers are at 110.90, 111.00 and 111.15.

Recently in the US, the ADP Employment Change for June 2018 was released by the Automatic Data Processing, Inc. The market was looking for an increase of 190K in the private-sector employment.

However, the result was slightly less as the change was 177K, on a seasonally adjusted basis. Commenting on the same, the chief economist of Moody’s Analytics, Mark Zandi, stated:

Business’ number one problem is finding qualified workers. At the current pace of job growth, if sustained, this problem is set to get much worse. These labor shortages will only intensify across all industries and company sizes.

Overall, the result was positive, but the next move in USD/JPY could be based on today’s NFP report. The market is looking for a rise of 195K in jobs, less than the last 223K. If the actual is above the 180K figure, the US Dollar may gain bullish traction in the near term.

Economic Releases to Watch Today

- US nonfarm payrolls June 2018 – Forecast 195K, versus 223K previous.

- US Unemployment Rate June 2018 – Forecast 3.8%, versus 3.8% previous.

- US Average Hourly Earnings (MoM) June 2018 – Forecast 0.3%, versus 0.3% previous.

- Canada’s employment Change June 2018 – Forecast 24.0K, versus -7.5K previous.

- Canada’s Unemployment Rate June 2018 – Forecast 5.8%, versus 5.8% previous.