The GBPUSD currency pair has been recovering in the form of a bullish ZigZag, and at this point we can see a clear consolidation. The consolidation is occurring exactly between two important pivot points, that might break soon after the CPI data release, which is scheduled for 8:30 AM GMT+2. You can track economic announcements such as this via our Forex calendar, to ensure you don’t miss them!

The CPI (Consumer Price Index) is the UK’s most important inflation data. The Bank of England (BOE) uses it as the inflation target. Additionally, consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

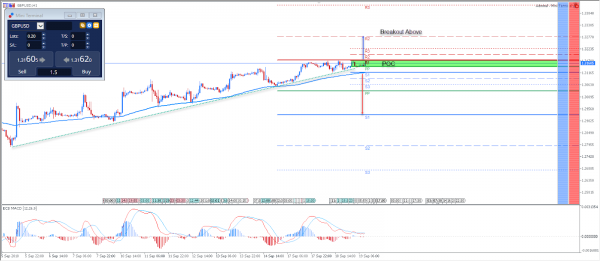

Technically, the GBPUSD is bullish above 1.3170 and the targets are 1.3200, 1.3226 and 1.3280. Bears might get the advantage if the GBPUSD currency pair drops below S1, and the targets should be 1.3092, 1.3035 and 1.2980. However, depending on the CPI, the price could be bought on the dip as the pair is still supported by technical confluence of a zig zag pattern, an EMA, and a rising trend line. Additionally, the CPI is good for news traders, and attempting to make a potential trade just after a news release could be a good strategy for a fast scalping entry. Look for a deviation between the forecast results, as any deviation from the actual results might bring a lot of movement in the pair.

Short Pivot Lines – Daily Support and Resistance

Long Pivot Lines – Weekly Support and Resistance

POC – POC – Point Of Confluence (The zone where we expect the price to react – aka the entry zone)