Key Highlights

- The British Pound recovered and broke the 146.40 resistance against the Japanese Yen.

- GBP/JPY cleared a crucial bearish trend line with resistance at 145.80 on the 4-hours chart.

- The UK Construction PMI in March 2019 increased from 49.5 to 49.7.

- The UK Services PMI for March 2019 is likely to decline from 51.3 to 50.9.

GBPJPY Technical Analysis

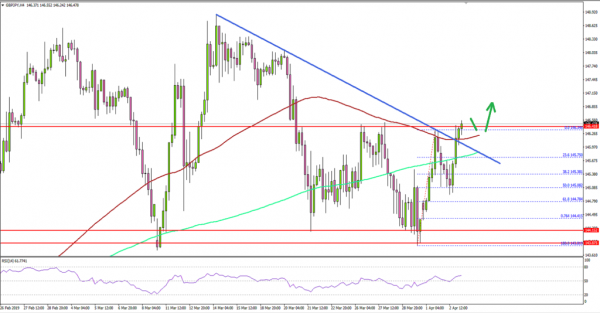

This past week, the British Pound tested the key 144.00 support area against the Japanese Yen. The GBP/JPY recovered recently and gained momentum above the 145.00 resistance.

Looking at the 4-hours chart, the pair started a solid upward move from the 143.81 swing low. It climbed above the 144.00 and 145.00 resistance levels. Buyers even pushed the price above the 146.00 level and the 200 simple moving average (4-hours, green).

More importantly, buyers pushed the pair above the key 146.20-146.40 resistance zone. Besides, the pair cleared the 100 simple moving average (4-hours, red), and a crucial bearish trend line with resistance at 145.80 on the same chart.

Intermediately, there was a short term downside correction, but the pair found support near the 50% Fib retracement level of the last wave from the 143.81 low to 146.34 high.

It seems like the pair is now trading above a strong resistance near the same trend line, 146.00, and the 100 simple moving average (4-hours, red). A successful close above 146.50, plus a follow through above 146.60 could only open the doors for further gains.

Conversely, a continuous failure near 146.60 or 146.80 might call for a fresh decline towards the 145.50 support area in the coming sessions.

Fundamentally, the UK Construction PMI for March 2019 was released by both the Chartered Institute of Purchasing & Supply and the Markit Economics. The market was looking for a rise from the last reading of 49.5 to 49.8.

The actual result was lower than the forecast, as the UK Construction PMI increased to 49.7 and posted contraction, signaling sight reduction in overall construction output.

The report added:

Another fall in commercial work and civil engineering activity more than offset a modest upturn in residential building. New business and employment numbers increased only slightly at the end of the first quarter, reflecting subdued underlying demand and delays to decision-making among clients.

Overall, the British Pound could struggle in the short term and it seems like both GBP/USD and GBP/JPY might slide before a fresh increase.

Economic Releases to Watch Today

- Germany’s Services PMI for March 2019 – Forecast 54.9, versus 54.9 previous.

- Euro Zone Services PMI for March 2019 – Forecast 52.7, versus 52.7 previous.

- UK Services PMI for March 2019 – Forecast 50.9, versus 51.3 previous.

- US Services PMI for March 2019 – Forecast 54.8, versus 54.8 previous.

- US ADP Employment Change March 2019 – Forecast 170K, versus 183K previous.

- US ISM Non-Manufacturing Index for March 2019 – Forecast 58.0, versus 59.7 previous