Cable accelerated lower in early European session on Friday, extending strong fall from 1.2500 zone into third straight day.

Fresh weakness hit new two-week low on probe below 1.2300 handle and was sparked by comment from BoE policymaker Saunders, who said that it is very likely for central bank’s next move to be a rate cut, even if no-deal scenario is avoided.

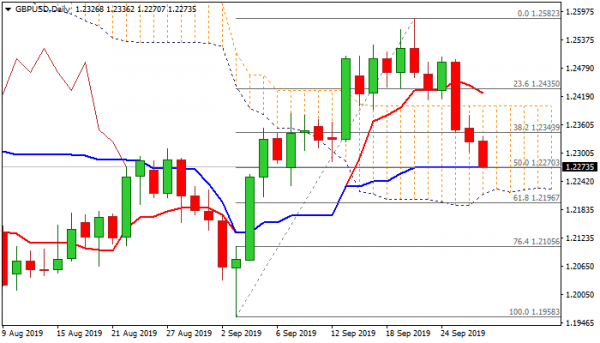

Last week the BoE said Brexit uncertainty and slower global growth caused reduced performance of the UK economy, which further soured already weak traders’ sentiment. Technical studies weakened further and support negative outlook, as bearish momentum is rising and daily MA’s turned to full bearish setup.

Thursday’s break and close below pivotal Fibo support at 1.2343 (38.2% of 1.1958/1.2582) was significant bearish signal.

Bears now pressure support at 1.2270 (50% retracement/daily Kijun-sen) and turn focus towards next key levels at 1.2226 (daily cloud base) and 1.2196 (Fibo 61.8% of 1.1958/1.2582).

Deeply oversold daily stochastic warns of consolidative/corrective action in the near-term, but so far without stronger signal as indicator continues to head south.

Broken 30DMA offers immediate resistance at 1.2304, with stronger upticks expected to stay under broken Fibo level at 1.2343 and keep bears intact. The pair is on track for strong bearish weekly close (the biggest weekly fall since the last week of July) that completes reversal signal on weekly chart and adds to negative signals.

Res: 1.2283, 1.2304, 1.2343, 1.2355

Sup: 1.2233, 1.2226, 1.2196, 1.2105