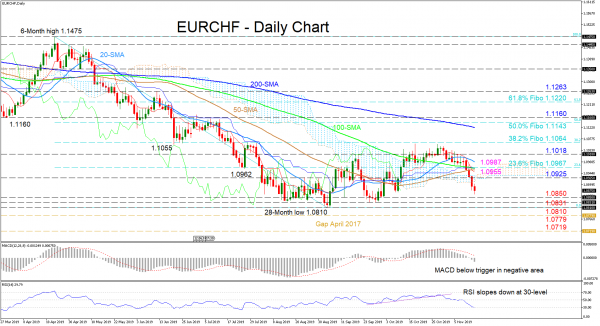

EURCHF sellers continue to drive the pair down, pushing it back towards multi-year low levels. During October, buyers’ efforts were unsuccessful in breaching the capping 1.1064 resistance level, which is the 38.2% Fibonacci retracement of the down leg from 1.1475 to 1.0810, with the price eventually piercing below the simple moving averages (SMAs) and Ichimoku cloud.

The technical indicators reflect increasing negative momentum. The MACD has distanced itself below its red trigger line, while the RSI is at the 30-level, looking to slip into the oversold territory. The Tenkan-sen has fulfilled a bearish crossover of the Kijun-sen line, while the 20-day SMA has turned back down towards the 100- and 50-day SMAs, both backing the negative view.

If selling interest persists, the bears face a congested floor of supports, starting with 1.0850, followed by the swing low of 1.0831. Overcoming these supports could turn traders’ attention to the multi-year low of 1.0810, keeping in mind that if violated, their next target may be to fill the gap from April of 2017, of 1.0779 to 1.0719.

Reversing back up, the bulls would initially have to overrun the 1.0925 resistance and the cloud before tackling a reinforced region from 1.0955 to 1.0987, which includes the 50-, 100- and 20-day SMA, the Ichimoku lines and the 23.6% Fibo. Overcoming this, the 1.1018 resistance and 38.2% Fibo of 1.1064 could further test the climb.

Overall, the short-term looks bearish and a break below 1.0810 would enhance the bigger negative sentiment, while a shift above 1.1160 could turn the bias bullish.