Key Highlights

- GBP/USD declined after it failed to surpass the 1.2970-1.2980 resistance area.

- It found support above 1.2820 and recently corrected towards the 1.2900 resistance.

- EUR/USD is trading in a bearish zone below the 1.1050 pivot level.

- The US New Home Sales could increase 1.2% in Oct 2019 (MoM).

GBP/USD Technical Analysis

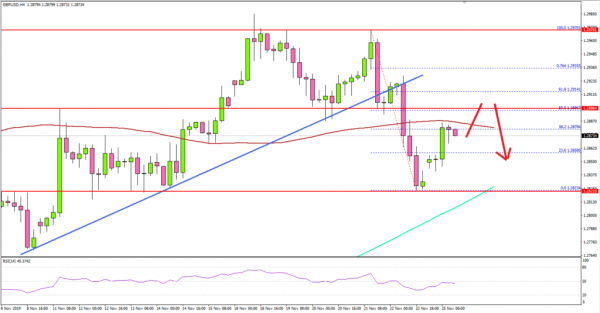

This past week, the British Pound faced a strong resistance near the 1.2970 and 1.2980 levels against the US Dollar. As a result, GBP/USD started a fresh decline and broke the key 1.2900 support area.

Looking at the 4-hours chart, the pair traded below a major bullish trend line with support near 1.2930. Moreover, there was a close below the 1.2900 support and the 100 simple moving average (red, 4-hours).

Finally, the pair traded below the 1.2850 support, but it managed to stay above the 1.2820 support area and the 200 simple moving average (green, 4-hours).

A swing low was formed near 1.2823 and the pair recently corrected above 1.2850. Besides, it surpassed the 23.6% Fib retracement level of the downward move from the 1.2970 high to 1.2823 low.

However, the pair is facing a strong resistance near 1.2890, 1.2900, and the 100 SMA. More importantly, the 50% Fib retracement level of the downward move from the 1.2970 high to 1.2823 low is near the 1.2900 level.

Therefore, a successful close above the 1.2900 resistance could start a nice upward move towards the 1.2950 and 1.2970 levels.

Conversely, GBP/USD could resume its decline. An initial support is near the 1.2800-1.2820 area and the 200 SMA. If there is a downside break below 1.2800, the pair could accelerate lower towards the 1.2760 region.

Fundamentally, the Chicago Fed National Activity Index (CFNAI) for Oct 2019 was released by the Federal Reserve Bank of Chicago. The market was looking for a minor increase from -0.45 to -0.43.

However, the actual result was disappointing, as the Chicago Fed National Activity Index (CFNAI) declined from -0.43 to -0.71.

The report stated:

The index’s three-month moving average, CFNAI-MA3, moved down to –0.31 in October from –0.21 in September. Two of the four broad categories of indicators that make up the index decreased from September, and all four categories made negative contributions to the index in October.

Overall, GBP/USD could struggle to gain strength above 1.2900, but if it does there could be a nice rally. Conversely, EUR/USD is trading in a bearish zone below the 1.1050 and 1.1080 resistance levels.

Upcoming Economic Releases

- US New Home Sales for Oct 2019 (MoM) – Forecast +1.2% versus -0.7% previous.

- US CB Consumer Confidence Nov 2019 – Forecast 126.9, versus 125.9 previous.