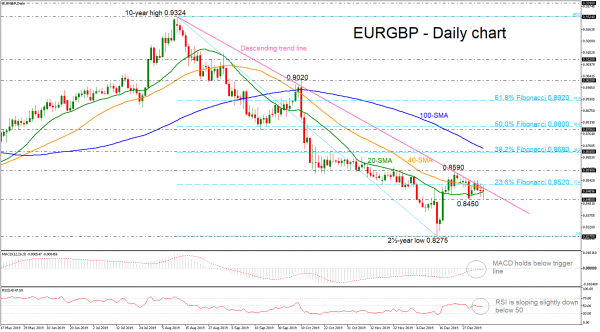

EURGBP is moving slightly lower over the last ten days, following the pullback on the 0.8590 resistance and the descending trend line, which has been holding since the ten-year peak of 0.9324 last August.

Currently, the price is developing within the 20- and 40-simple moving averages (SMAs) in the daily timeframe, which act as support and resistance respectively. The MACD oscillator is flattening below the zero line, while the RSI is moving slightly lower below the 50 level, signaling a continuation of the recent bearish sentiment.

Should the price close comfortably below the 20-SMA (0.8480), which has been restrictive to downside correctionsover the past week, the next level to watch is the 0.8450 barrier. The two-and-a-half-year low of 0.8275 has been strictly supportive as well and therefore should be in focus.

In the positive scenario, if the price surpasses the 23.6% Fibonacci retracement level of the downleg from 0.9324 to 0.8275 of 0.8520, penetrating the downtrend line too, the market could retest the peak of 0.8590. If this proves easy to overcome this time, the advance may next pause somewhere between the 38.2% Fibo of 0.8680 and the 100-SMA at 0.8695.

In brief, EURGBP is in negative mode in all timeframes, but is moving with weak momentum.