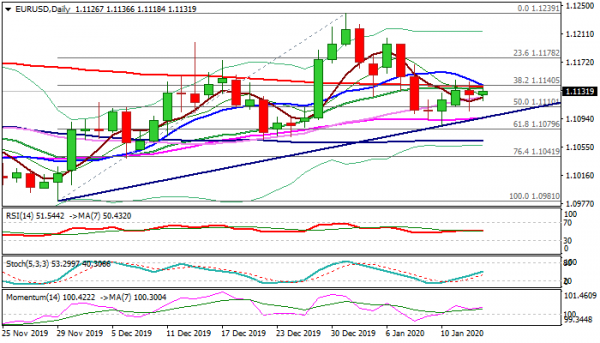

Attempts to extend recovery after strong downside rejection last Friday remain limited by a cluster of key barriers at 1.1140 zone (200DMA / double Fibo barrier / converged daily Tenkan-sen/Kijun-sen).

Long shadow on Friday’s daily candle underpins the action along with rising stochastic, but flat momentum and RSI and converging 10/200DMA’s, in attempt to form death-cross, are factors that offset positive signals.

Larger picture shows an uptrend from 1.0981 (29 Nov low) still intact and keeps focus at the upside.

Eventual break above 1.1140 zone pivots would signal formation of higher low at 1.1084 (10 Jan) and spark fresh bullish acceleration towards barriers at 1.1180 (Fibo 61.8% of 1.1239/1.1084) and 1.1200 (round-figure / 6 Jan recovery rejection).

Conversely, repeated failure to close above cracked 1.1140 zone would increase risk of stall and pullback.

Close below 30DMA (1.1123) would generate initial bearish signal which would look for confirmation on extension and close below 1.1104 (Tuesday’s spike low) to open way for retest of 1.1084 low.

Res: 1.1140, 1.1162, 1.1180, 1.1205

Sup: 1.1123, 1.1104, 1.1084, 1.1066