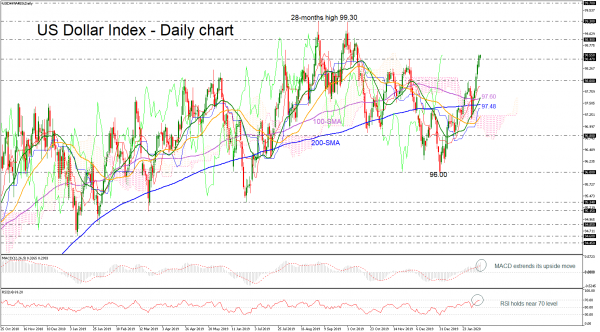

The US dollar index reached a fresh four-month high of 98.56 as the price extended its bull run well above the Ichimoku cloud and the moving averages lines. Prices broke above the 98.47 barrier and the technical indicators are suggesting a weaker bullish move.

The MACD is holding above the trigger and zero lines, while the RSI flattens near the 70 level. It is worth mentioning that the 20-day simple moving average (SMA) crossed above all the short- and long-term moving averages.

A move to the upside could see immediate resistance at 98.90, taken from the highs on October 8 but should the market increase positive momentum above this area, the 28-month high of 99.30 could be the next level in focus. A stronger barrier, though, could be found at the 99.70 hurdle, registered on May 2017.

In the wake of negative pressures, the market could meet support at the 98.00 psychological mark before it heads lower to the 100-day SMA, which overlaps with the 20-day SMA at 97.60. Marginally below this line, the 200-day SMA at 97.48 and the upper surface of the Ichimoku cloud at 97.23 would increase selling interest.

In the longer timeframe, the outlook seems to be neutral as there is no clear direction. If there is a climb above the 28-month peak of 99.30, the trend would turn positive.