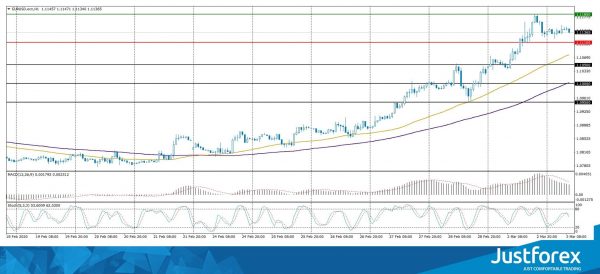

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.10416

Open: 1.11305

% chg. over the last day: +0.83

Day’s range: 1.11203 – 1.11555

52 wk range: 1.0879 – 1.1572

Greenback continues to lose positions against the single currency. Yesterday the growth of EUR/USD quotes exceeded 100 points. The trading instrument reached two-month highs. The U.S. dollar remains under pressure amid growing expectations that the Fed will cut interest rates to support the U.S. economy amid the spread of the COVID-19 virus. Currently, the EUR/USD currency pair is consolidating in the range of 1.11100-1.11850. We expect inflation statistics from the EU. We recommend you to open positions from key levels.

At 12:00 (GMT+2:00) the EU will publish the report on inflation.

The indicators signal the power of buyers: the price has fixed above 50 MA and 100 MA.

MACD histogram is in the positive zone, which gives a signal to buy EUR/USD.

The Stochastic Oscillator is in the neutral zone, the %K line crosses the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.11100, 1.10500, 1.10000

Resistance levels: 1.11850, 1.12200, 1.12500

If the price fixes above 1.11850, expect further growth toward 1.12200-1.12500.

Alternatively, the quotes could descend toward 1.10600-1.10400.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.27878

Open: 1.27509

% chg. over the last day: -0.29

Day’s range: 1.27405 – 1.27973

52 wk range: 1.1959 – 1.3516

The GBP/USD currency pair has stabilized. Financial markets participants are waiting for additional drivers. At the moment sterling is in sideways movement with a rather wide range. The key support and resistance levels are 1.27400 and 1.28100, respectively. Today investors will evaluate important economic reports from UK. We recommend you to open positions from key levels.

At 11:30 (GMT+2:00) an index of business activity in the UK construction sector will be published.

The indicators signal the sellers’ power: the price has fixed below 50 MA and 100 MA.

The MACD histogram is in the negative zone but above the signal line, which gives a weak signal to sell GBP/USD.

The Stochastic Oscillator is located in the overbought zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.27400, 1.27000

Resistance levels: 1.28100, 1.28550, 1.29000

If the price fixes below the support level at 1.27400, expect the quotes to fall toward 1.27000-1.26800.

Alternatively, the quotes could grow toward 1.28500-1.28800.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.34332

Open: 1.33288

% chg. over the last day: -0.60

Day’s range: 1.33188 – 1.33629

52 wk range: 1.2949 – 1.3566

There is a mixed technical picture on the USD/CAD currency pair. At the moment Loonie is consolidating. The trading instrument tests local support and resistance levels: 1.33200 and 1.33650, respectively. USD/CAD quotes can correct further. We recommend that you pay attention to the black gold price dynamics. We recommend you to open positions from key levels.

The Economic News Feed for 03.03.2020 is calm.

Indicators do not give accurate signals: the price has crossed 100 MA.

Histogram of MACD is in the negative zone, which indicates a bearish sentiment.

The Stochastic Oscillator is located near the overbought zone, the %K line is above the %D line, which gives a weak signal to buy USD/CAD.

Trading recommendations

Support levels: 1.33200, 1.32950, 1.32650

Resistance levels: 1.33650, 1.34000, 1.34600

If the price fixes below 1.33200, expect the quotes to correct toward 1.32900-1.32600.

Alternatively, the quotes could grow toward 1.34000-1.34300.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 107.449

Open: 108.316

% chg. over the last day: +0.79

Day’s range: 107.661 – 108.536

52 wk range: 104.45 – 113.53

USD/JPY quotes continue to consolidate after a prolonged decline. There is no defined trend. The trading instrument tests key support and resistance levels at 107.400 and 108.500, respectively. Technical correction of USD/JPY currency pair is not excluded in the nearest future. We recommend that you pay attention to the dynamics of the US government securities yield. We recommend you to open positions from key levels.

The Economic News Feed for 03.03.2020 is calm.

Indicators do not give accurate signals: the price has crossed 50 MA.

The MACD histogram is near the 0 mark.

The Stochastic Oscillator started to exit the oversold area, the %K line is above the %D line, which indicates the development of bullish sentiment.

Trading recommendations

Support levels: 107.400, 107.000

Resistance levels: 108.500, 109.300, 110.000

If the price fixes above 108.500, USD/JPY quotes are expected to correct to 109.000-109.500.

Alternative, the quotes could decline toward 107.000.