Key Highlights

- EUR/GBP rallied recently above the 0.8600 and 0.8700 resistance levels.

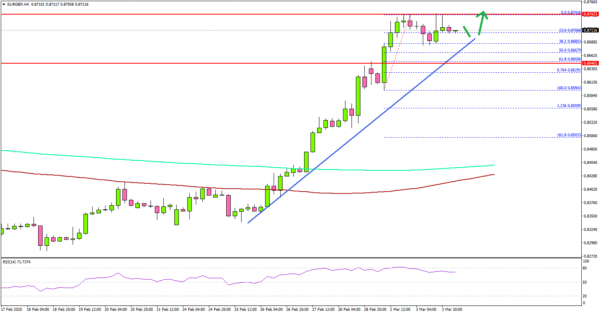

- A key bullish trend line is forming with support near 0.8660 on the 4-hours chart.

- The Euro Zone CPI increased 1.2% in Feb 2020 (Prelim) (YoY), similar to the forecast.

- In an emergency rate cut, the Fed reduced interest rates from 1.75% to 1.25%.

EUR/GBP Technical Analysis

In the past few days, the Euro gained a strong bullish momentum above 0.8550 against the British Pound. As a result, EUR/GBP rallied significantly above the 0.8600 and 0.8700 levels.

Looking at the 4-hours chart, the pair settled nicely above the 0.8650 pivot level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

It opened the doors for more gains above the 0.8700 and 0.8720 levels. The pair traded close to the 0.8750 level and it is currently consolidating gains with corrective moves.

On the downside, there are many key supports forming near 0.8700, 0.8680 and 0.8650. Moreover, there is a key bullish trend line forming with support near 0.8660.

On the upside, a clear break above the 0.8750 and 0.8760 resistance levels could open the doors for a larger rally in the near term. Conversely, a close below 0.8650 might lead the pair towards the 100 SMA.

Fundamentally, the Euro Zone CPI report for Feb 2020 (prelim) was released by the Eurostat. The market was looking for a 1.2% increase in the CPI compared with the same month a year ago.

The actual result was in line with the forecast, as the Euro Zone CPI increased 1.2% (YoY). Looking at the Core CPI, there was a 1.2% increased, up from the last 1.1%.

The report added:

Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in February (2.2%, compared with 2.1% in January), followed by services (1.6%, compared with 1.5% in January), non-energy industrial goods (0.5%, compared with 0.3% in January) and energy (-0.3%, compared with 1.9% in January).

Overall, the Euro remains well bid and it is likely to continue higher against the US Dollar and the British Pound.

Upcoming Economic Releases

- Germany’s Services PMI for Feb 2020 – Forecast 53.3, versus 53.3 previous.

- Euro Zone Services PMI for Feb 2020 – Forecast 52.8, versus 52.8 previous.

- UK Services PMI for Feb 2020 – Forecast 53.3, versus 53.3 previous.

- US Services PMI for June 2020 – Forecast 49.4, versus 49.4 previous.

- US ISM Non-Manufacturing Index for Feb 2020 – Forecast 54.9, versus 55.5 previous

- BoC Interest Rate Decision – Forecast 1.75%, versus 1.75% previous.