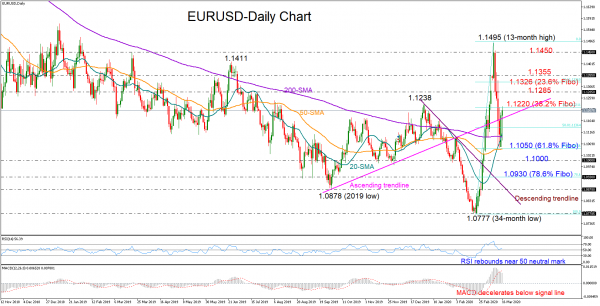

EURUSD is congested between the 1.1050 and 1.1220 borders formed by the 61.8% and 38.2% Fibonacci retracements levels of the 1.0777-1.1495 upleg after last week’s free-fall.

From a technical point of view, the rising RSI indicates that the pair could recoup some lost ground in the short-term, though with the MACD keep decelerating below its red signal line, any upside correction is in speculation at the moment. Moreover, it remains to be seen if the 20-day simple moving average (SMA) manages to successfully cross above the 200-day SMA this time after January’s failure, increasing hopes for a trend improvement.

For now, there is a strong support around the 61.8% Fibonacci of 1.1050 and the 50-day SMA that needs to be washed out for the bears to reach the 1.1000 round level. Lower, the descending trendline from the 1.1238 high that coincides with the 78.6% Fibonacci of 1.0930 could be a reasonable barrier to watch before the focus shifts to the 2019 low of 1.0878.

Alternatively, the bulls should step on the ascending trendline and close decisively on top of the 38.2% Fibonacci of 1.1220 in order to re-challenge the 1.1285 former resistance region. Higher, the 1.1326-1.1355 zone could be a stronger obstacle, a break of which could bring the 1.1450 into view ahead of the 1.1500 round level.

Looking at the medium-term picture, the pair has no specific direction at the moment. That said, it has posted a higher high at 1.1495, and if it manages to register a higher low above 1.0777, that could be a positive signal that an uptrend may be in progress.

Summarizing, short-term downside risks have not fully faded in the EURUSD market, while in the medium-term the neutral outlook may remain in place. Positive trend signals in both timeframes will be closely evaluated as well.