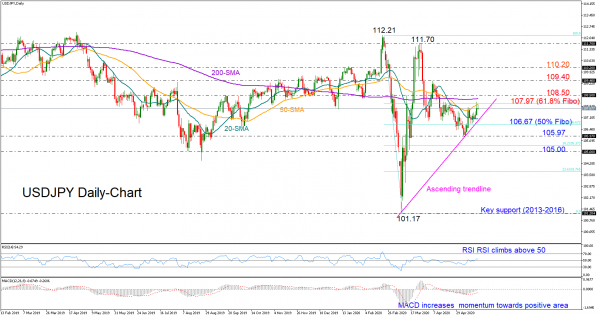

USDJPY controlled by the 20- and 50-day simple moving averages (SMAs) the past few sessions is pushing for another soft green week that could see a test of the 108.50 barrier if the bulls manage to successfully breach the 50-day SMA and resistance around 107.97– being the 61.8% Fibonacci of the down leg with a top at 112.21 and a low at 101.17.

According to the momentum indicators, another upside correction is possible as the RSI and the MACD are trending upwards. Should a steeper rally above 108.50 happen, the bullish action could initially pause near 109.40 and then around 110.20. Additional gains could set the stage for the March peak of 111.70.

On the downside, there is a tentative ascending trendline drawn from the 101.17 low which could potentially provide some footing to the price with the help of the 20-day SMA and the 50% Fibonacci of 106.67 if sellers return. In the event the latter fails to catch the fall, the focus would shift to the 105.97 trough, while deeper the 105.00 mark could be the next target.

Looking at the medium-term picture, the pair continues to range within the 101.17 and 112.21 borders, keeping the outlook neutral.

In brief, the short-term risk is skewed to the upside for USDJPY, with the bulls likely waiting for a closure above 107.97 to confirm the bullish signals.