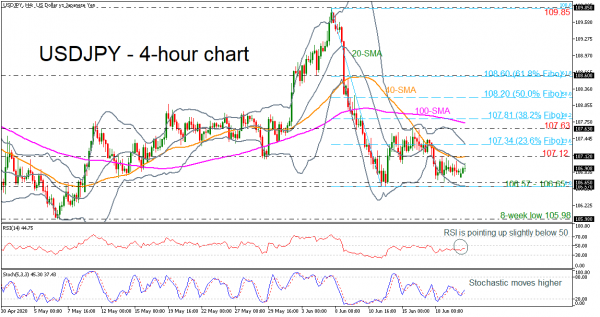

USDJPY has been underperforming in the past few days, flirting with the mid-level of the Bollinger band, hovering around the 107.00 psychological mark. When looking at the last two weeks, the pair lacks a clear trend and has been consolidating after its bearish run from 109.85 stalled at 106.57.

On the 4-hour chart, the RSI indicator is moving north in the negative territory, while the %K line of the stochastic oscillator created a bullish crossover with the %D line. The Bollinger Band is titled to the downside at the moment, suggesting more losses.

If price action jumps above the 107.12 resistance, which coincides with the 40-period simple moving average (SMA), there is scope to test the upper Bollinger band and the 23.6% Fibonacci retracement level of the down leg from 109.85 to 106.57 at 107.34. Rising above it would see prices re-test the 107.63 barrier and then the 100-period SMA at 107.73. Marginally above this line, the 38.2% Fibo of 107.81 could be a significant signal for an upside rally towards the 50.0% Fibo of 108.20.

Alternatively, if the 106.57 – 106.65 support area fails then the focus would shift to the downside towards the eight-week low of 105.98. Breaching this obstacle, would increase speculation for more downside pressure towards the 105.20 support, taken from the low on March 16.

Overall, USDJPY has been bearish-to-neutral in the short-term timeframe since peaking at 109.85. Near-term weakness is expected to remain as long as price action takes place below the mid-level of the Bollinger band.