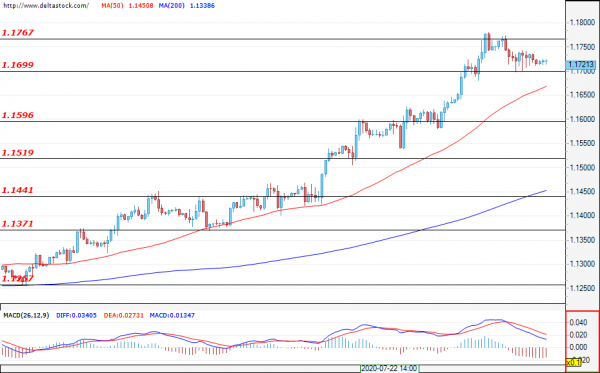

EUR/USD

Current level – 1.1721

The Euro lost a bit of steam after it reached the resistance at around 1.1767. At the time of writing, the pair is holding steady above the support at 1.1700. It’s too early to say whether the rally is showing signs of weakness as the current retracement is looking more like bulls taking profits rather than bears actually entering the market. The resistance zone at 1.1767 is coming from the higher time frames, so it’s possible for the current market to enter into a range or experience a deeper pullback. If this proves to be the case, bullish bias would remain as long as prices hold above the support of 1.1440. If bulls renew the buying pressure, the next zone after 1.1767 is 1.1812. Intraday supports lie at around 1.1700 and 1.1590. Today, the main focus of investors will be towards FOMC’s interest rate decision (18:00 GMT) and the following press conference (18:30 GMT).

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1810 | 1.1810 | 1.1699 | 1.1520 |

| 1.1930 | 1.1930 | 1.1596 | 1.1440 |

USD/JPY

Current level – 105.06

The pair slowed down its freefall after it found support at around 105.10. There might be a pullback move that should remain limited below 106.00 or 106.72 at most. The intraday resistance is found at around 105.66. The U.S. dollar could continue to weaken and the pair could test the lows at around 102.00 in the mid-term. The news mentioned in the EUR/USD section are expected to affect this pair as well and we might see a ranging market until the news is released.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 105.66 | 106.72 | 105.09 | 103.10 |

| 106.04 | 107.38 | 104.00 | 102.00 |

GBP/USD

Current level – 1.2919

The Sterling is also part of the gainers against the softer Greenback. The pair managed to pull closer to the powerful resistance zone of 1.2960-1.2980, after which the bulls lost a bit of their momentum. Here, a more substantial support can be found at around 1.2850. The market is showing a slight divergence, so a retracement here is fairly possible. Bulls are currently dominating and can count on a massive support at around 1.2720-1.2760. If we track the larger swings of the pair, major obstacles for the bulls would be the levels of 1.3100 and 1.3200. These zones can be crucial for sustaining the further rally of the pound. Today, a series of credit market data (08:30 GMT), along with the FED’s interest rate decision (18:00 GMT), are expected to influence the market.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.2960 | 1.3100 | 1.2900 | 1.2760 |

| 1.3050 | 1.3200 | 1.2846 | 1.2660 |