Key Highlights

- GBP/JPY is trading in a positive zone above the 138.00 and 138.40 support levels.

- GBP/USD extended its rise above the 1.3200 resistance zone.

- The UK CPI is likely to increase 0.6% in July 2020 (YoY), similar to the last reading.

- The Euro Zone CPI could remain at 0.4% in July 2020 (YoY).

GBP/JPY Technical Analysis

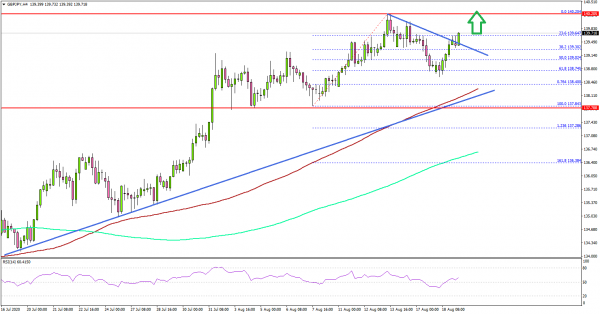

This past week, the British Pound gained pace above 139.00 against the Japanese Yen. GBP/JPY even spiked above the 140.00 resistance before it started a downside correction.

Looking at the 4-hours chart, the pair declined below the 139.20 support level, but it remained well above the 100 simple moving average (red, 4-hours). There was a break below the 50% Fib retracement level of the upward move from the 137.84 swing low to 140.20 high.

However, the pair found support near the 138.80 level. There is also a crucial support forming near the 138.40 level, a connecting bullish trend line, and the 100 SMA. The main support is near the 138.00 area, below which there is a risk of a sharp decline.

On the upside, the pair is facing a couple of hurdles near the 139.80 and 140.00 levels. A successful close above the 140.00 barrier could start a fresh increase in the coming sessions.

Looking at GBP/USD, the pair gained pace above the 1.3200 resistance and it traded to a new monthly high. Similarly, EUR/USD broke the 1.1920 resistance and extended its upward move.

Upcoming Economic Releases

- UK CPI July 2020 (YoY) – Forecast +0.6%, versus +0.6% previous.

- UK Core CPI July 2020 (YoY) – Forecast +1.3%, versus +1.4% previous.

- Euro Zone CPI July 2020 (YoY) – Forecast +0.4%, versus +0.4% previous.

- Euro Zone Core CPI July 2020 (MoM) – Forecast +1.2%, versus +1.2% previous.

- Canadian CPI July 2020 (MoM) – Forecast +0.4%, versus +0.8% previous.

- Canadian CPI July 2020 (YoY) – Forecast +0.5%, versus +0.7% previous.