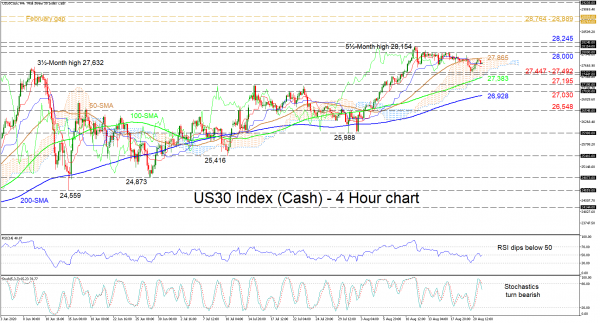

US 30 stock index (Cash) drifted into the Ichimoku cloud and under the now capping 50-period simple moving average (SMA) after reaching a 5½-month high of 28,154. The waning positive momentum in the index is sponsored by the negative tone of the Ichimoku lines and, specifically, the fading red Tenkan-sen line.

The short-term oscillators further support the negative move in the pair. The RSI slipped below its 50 neutral mark, while the stochastic oscillator cemented its bearish demeanour, breaking below the overbought zone. Some caution is warranted though, as the SMAs retain a positive charge, promoting advancements.

If sellers take control and steer beneath the Ichimoku lines, initial hardened support may arise from the 27,447 – 27,492 zone and the 100-period SMA at 27,383 underneath, where the cloud’s lower surface resides. If this area fails to stop the retreat, the price may drop towards a key 27,195 low. Should steeper declines unfold past the 27,030 barrier, the 200-period SMA at 26,928 may prevent the fall from extending towards the 26,548 trough.

Alternatively, if buyers manage to thrust the price above the 50-period SMA of 27,865 – at the ceiling of the cloud – the 28,000 handle may obstruct the climb from revisiting the recent peak of 28,154. Should buyers maintain a drive above the peak and the 28,245 nearby obstacle, the index could stretch higher in an attempt to fill the gap from back in February.

Summarizing, to keep the ascent on track, the index would need to refrain from initially weakening below the cloud and the 100-period SMA, but more importantly below 27,030. Nonetheless, a shift below 25,988 could trigger negative worries.