Key Highlights

NZD/USD started a steady decline below the 0.6650 and 0.6600 support levels.

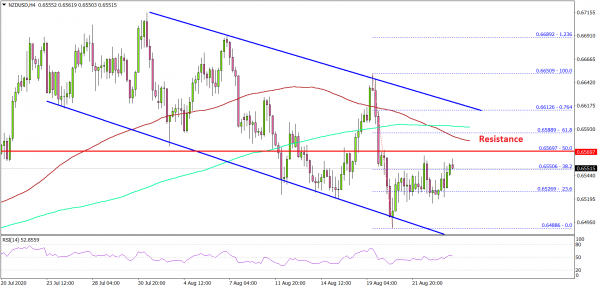

- A major declining channel is forming with resistance near 0.6600 on the 4-hours chart.

- New Zealand’s trade balance in July 2020 (YoY) posted a deficit of $-0.12 B.

- The US Durable Goods Orders might increase 4.3% in July 2020.

NZD/USD Technical Analysis

In the past few days, the New Zealand Dollar started a strong decline from the 0.6700 resistance against the US Dollar. NZD/USD broke the 0.6650 and 0.6600 support levels to move into a bearish zone.

Looking at the 4-hours chart, the pair followed a bearish path from well above 0.6650. There was also a close below 0.6600 and the 100 simple moving average (red, 4-hours).

The pair even spiked below the 0.6500 support and traded to a new monthly low at 0.6488. Recently, there was an upside correction above the 0.6520 level. The pair climbed above the 23.6% Fib retracement level of the recent decline from the 0.6650 high to 0.6488 low.

However, the pair is facing hurdles near the 0.6570 and 0.6600 levels. The 50% Fib retracement level of the recent decline from the 0.6650 high to 0.6488 low is also near the 0.6570 level to act as a resistance.

More importantly, there is a major declining channel forming with resistance near 0.6600 on the same chart. Therefore, the pair must climb above 0.6600 to move into a positive zone.

If not, there is a risk of more losses below the 0.6500 support zone. The next support is near 0.6480, below which NZD/USD might test 0.6450.

Looking at EUR/USD, the pair needs to gain pace above 1.1850 for a fresh increase. Similarly, GBP/USD is facing hurdles near 1.3200 and 1.3250.

Upcoming Economic Releases

- US Durable Goods Orders for July 2020 – Forecast +4.3% versus +7.6% previous.

- US Durable Goods Orders ex Transportation for July 2020 – Forecast +2.0% versus +3.6% previous.