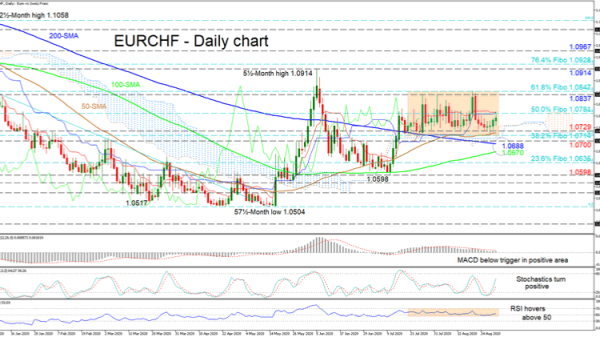

EURCHF appears to have found a foothold on the 50-day simple moving average (SMA) and near the bottom of the sideways market. The Ichimoku lines reflect the neutral tone, which has controlled the pair for the last one-and-a-half-months. Nevertheless, a nearing bullish crossover of the 200-day SMA by the 100-day one looks to be forming, as the 50- and 100-day SMAs hold their gradual positive incline.

The short-term oscillators suggest that positive momentum may be picking up. The MACD remains in the positive zone but below its red signal line, while the RSI is starting to develop above its 50 threshold. Moreover, the stochastic oscillator promotes advances as it maintains a positive bearing heading for the 80 mark.

If the pair picks up momentum, immediate resistance could unfold from the Ichimoku lines at the 1.0781 level, which also happens to be the 50.0% Fibonacci retracement of the down leg from 1.1058 to 1.0504. Pushing higher, buyers may face the ceiling of the neutral market, a buffer zone from the 1.0837 highs to the 61.8% Fibo of 1.0847. Overcoming this, the price may target the 5½-month peak of 1.0914 and the 76.4% Fibo of 1.0928 overhead. A sustained drive up may even stretch the pair towards the 1.0967 obstacle.

Alternatively, if sellers push down, durable support may arise from the floor of the consolidation and the cloud. The foundation commences from the 1.0729 lows until the 38.2% Fibo of 1.0714, encompassing the 50-day SMA as well. Slipping below the cloud and the 1.0700 handle, the converging of the 200- and 100-day SMAs currently at 1.0688 and 1.0670 could halt the decline from meeting the 23.6% Fibo of 1.0635 and the 1.0598 trough.

Concluding, EURCHF preserves a neutral-to-bullish tone above the SMAs. A break above 1.0847 or below 1.0700 could reveal the very short-term direction.