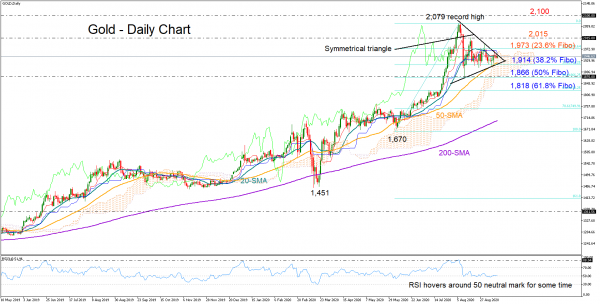

Gold opened with weak momentum on Monday, showing little interest to exit the one-month old horizontal trajectory that is taking place within the 1,900-2,000 area.

Although not very clear, the sideways move seems to be completing a symmetrical triangle, where any clear break below or above it could determine the next direction in the market.

Meanwhile the momentum indicators are reflecting a neutral-to-bearish short-term risk as the RSI continues to hover around its 50 neutral mark, while the Ichimoku indicators ( red Tenkan-sen, blue Kijun-sen) seem to be shifting downwards again. In terms of the trend, the reducing gap between the 50- and 20-day simple moving averages (SMAs) is of concern as it could result in a bearish crossover.

The negative scenario may prevail if the precious metal slips below the 1,914 level and the lower line of the triangle, piercing the 50-day SMA and the 38.2% Fibonacci of the 1,670-2,079 upleg at the same time. In this case, support could run towards the 50% Fibonacci of 1,866, a break of which could trigger fresh selling, likely towards the 61.8% Fibonacci of 1,818.

Alternatively, the bulls may dominate if the price flies above the triangle and more importantly closes above the 23.6% Fibonacci resistance of 1,973. Such a move may open the door for the swing high of 2,015 and then for the 2,079 top. Beyond the latter, the 2,100 psychological mark could be the next target.

In brief, gold is facing a neutral-to-bearish bias at the moment, with sellers waiting to take control below the triangle. An upside correction above 1,973 may eliminate downside risks.