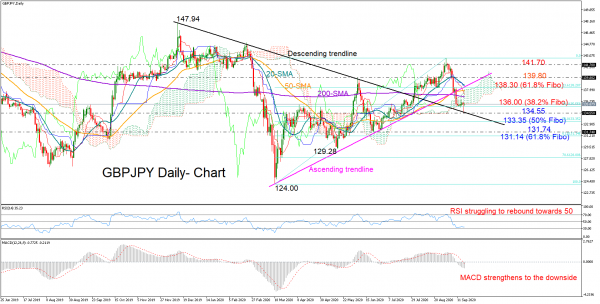

GBPJPY gathered enough support around 134.55 and a former resistance trendline on Thursday to continue the intense battle with the 136.00 ceiling where the bottom of the Ichimoku cloud and the 38.2% Fibonacci retracement of the March rally coincide.

The short-term bias, however, remains largely bearish as the red Tenkan-sen line maintains a negative slope below the blue Kijun-sen line. Also, the MACD continues to lose ground below its zero and signal lines, while the RSI seems unable to regain strength towards its 50 neutral mark.

A decisive close below the 38.2% Fibonacci of 135.55 could reach the 50% Fibonacci of 133.35 if the trendline gives way at 134.55. Lower, the next turning point may emerge within the 131.74-131.14 region framed by June’s lows and the 61.8% Fibonacci.

Alternatively, the price should successfully breach the 136.00 level to gain momentum towards the 23.6% Fibonacci of 138.30. The ascending trendline which joins all the troughs from the March bottom and the 20-day simple moving average (SMA) are in this neighborhood too, hinting that resistance here could turn tough. In case, the bulls win, the door would open for the 139.80 barrier, a break of which could see an extension towards the 141.70 region.

Meanwhile in the six-month picture, the higher highs and the higher lows keep the outlook positive and only a drop below 131.74 could switch it to neutral.

In brief, GBPJPY could remain under pressure in the short-term, where a sustainable move below 135.55 may trigger additional selling. Otherwise, a daily close above 136.00 could set the stage for more recovery as the medium-term outlook remains positive.