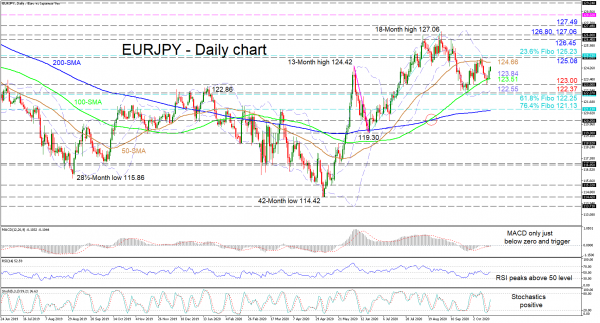

EURJPY, although turning higher from the 100-day simple moving average (SMA) at 123.51, appears to be steering into a sideways market. The fairly flattened slopes of the 50- and 200-day SMAs are piloting a more horizontal price formation, while the intact bullish bias in the SMAs and the rising 100-day one are upholding the positive structure.

The short-term oscillators are reflecting a pickup in positive momentum. The MACD has merged with its red signal line marginally below the zero mark, while the RSI is attempting to capitalise on its push above its neutral threshold. That said, the stochastic oscillator sustains a positive charge backing further advances.

If buyers maintain the current trajectory, early limitations may evolve from the 50-day SMA at 124.66 ahead of a dense resistance section from the 125.08 high until the 125.23 level, that being the 23.6% Fibonacci retracement of the up leg from 119.30 to 127.06. Manoeuvring above this zone, which also contains the upper Bollinger band, the pair may aim for the 126.45 peak before shooting for the 126.80 barrier and the 18-month top of 127.06. Successfully navigating above could then hit the 127.49 peak from March 1 of 2019.

To the downside, sellers face initial support from the mid-Bollinger band at 123.84 and the neighbouring 100-day SMA at 123.51 ahead of the 123.00 handle. Slipping further, a preventive base from the lower Bollinger at 122.55 until the 61.8% Fibo of 122.25, which encapsulates the trough of 122.37, may attempt to terminate the decline. However, should it fail to do so, the pair may dive for the 76.4% Fibo of 121.13 and the adjacent 200-day SMA.

In brief, should positive tones endure, EURJPY’s short-term neutral-to-bullish bias may receive a boost with a break above 125.23.