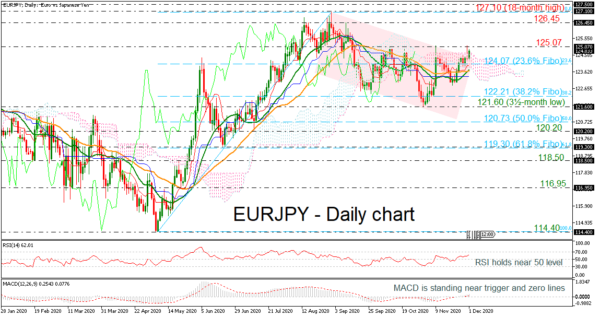

EURJPY is rising above the descending channel and near the Ichimoku line, suggesting an upside retracement over the last couple of days.

According to the simple moving averages (SMAs), the 20-day SMA completed a bullish crossover with the 40-day SMA, confirming the positive move around the 125.00 handle. The RSI indicator is approaching the overbought territory, while the MACD is jumping above its trigger and zero lines.

Immediate resistance could come from the 125.07 barrier, which halted bullish moves several times in the past. A successful increase above this line could open the door for the 126.45 obstacle ahead of the 18-month high of 127.10.

In the opposite scenario a sell-off beneath the 23.6% Fibonacci retracement of the up leg from 114.40 to 127.10 at 124.07 and the SMAs could take the pair towards the 38.2% Fibonacci of 122.21. If the selling interest persists, the next support could be at the three-and-a-half-month low of 121.60. Even lower, the 50.0% Fibonacci of 120.73 could come in focus, shifting the bias back to bearish.

Briefly, EURJPY had been under selling pressure? since the bounce off the 18-month high of 127.10, though the recent upside move may change the outlook to bullish in the short-term.

In the bigger picture, the pair has been remaining in a positive structure since May 6.