Key Highlights

- Gold price recovered higher above the $1,720 resistance zone.

- It is now facing resistance near $1,750 and $1,760 on the 4-hours chart.

- EUR/USD extended gains above 1.1920, GBP/USD is consolidating above 1.3670.

- USD/JPY could decline further if it breaks the 109.00 support zone.

Gold Price Technical Analysis

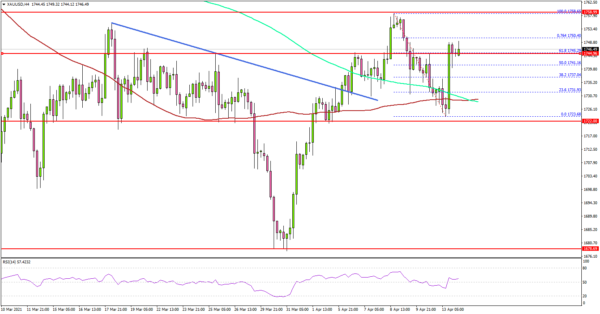

After retesting the $1,680 support zone, gold price started a fresh increase against the US Dollar. The price recovered nicely above the $1,700 and $1,720 resistance levels.

The 4-hours chart of XAU/USD indicates that the price gained pace above the $1,700 zone and it even cleared a connecting bearish trend line. It broke the next major resistance at $1,745.

It traded as high as $1,758 before correcting lower. The recent low was formed near $1,723 and the price is now rising steadily. It broke the 50% Fib retracement level of the downward move from the $1,758 swing high to $1,723 low.

The current price action suggests that the price might continue to rise above the $1,750 resistance. The main resistance is still near $1,760. A successful break above the $1,760 level could open the doors for a steady increase in the coming sessions.

Conversely, there might be a fresh decline below the $1,725 and $1,720 support levels. In the stated case, the price is likely to retest the $1,670 support zone.

Fundamentally, the US Consumer Price Index for March 2021 was released yesterday by the US Bureau of Labor Statistics. The market was looking for a 0.5% increase compared with the previous month.

The actual result was better than the forecast, as the US CPI increased 0.6%. The yearly change was 2.6%, up from the last 1.7%.

Looking at EUR/USD, the pair is still holding gains above 1.1850 and it climbed further. Besides, GBP/USD is still showing positive signs above 1.3670.

Economic Releases to Watch Today

- Euro Zone Industrial Production for Feb 2021 (MoM) – Forecast -1.1%, versus +0.8% previous.

- Fed’s Chair Powell speech.