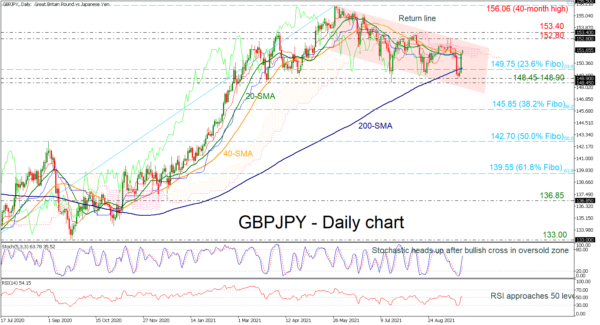

GBPJPY is advancing above the 200-day simple moving averages (SMAs) and the 23.6% Fibonacci retracement level of the up leg from 129.30 to 156.06 t 149.75, remaining in a medium-term downward sloping channel.

Regarding the technical indicators, the stochastic oscillator is turning upwards after the bullish crossover within the %K and %D lines in the oversold territory, suggesting a positive bias. Moreover, the RSI is rising in the positive region, following the rebound off the 30 level.

A break above the Ichimoku cloud and the return line of the channel would ease the downside pressure, while a climb above the 152.80-153.40 could help turn the medium-term bias to a bullish one.

If the bears take the upper hand again and the price drifts below the 23.6% Fibonacci, that could bring into play the 148.45-148.90 zone and the 38.2% Fibonacci of 148.85. More declines could take the market until the 50.0% Fibonacci of 142.70.

Overall, GBPJPY has been in a descending channel since May 27; however, a rise above the 40-month high of 156.06 could switch the outlook to positive.