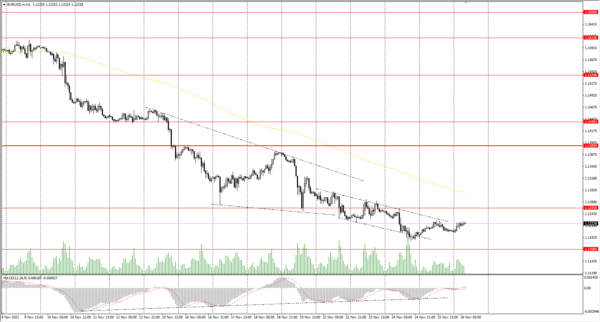

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.1196

Prev Close: 1.1205

% chg. over the last day: +0.08%

Germany’s GDP growth estimate for Q3 worsened to 1.7% from 1.8%. Analysts believe the economic performance across Europe will worsen in Q4 due to the introduction of new restrictions to combat the Covid-19 wave.

Trading recommendations

Support levels: 1.1168

Resistance levels: 1.1256, 1.1386, 1.1436, 1.1535, 1.1613, 1.1667, 1.1717

From a technical point of view, the EUR/USD pair is bearish on the hour time frame. The Euro continues to show weakness, the price is slowly declining, and buyers’ attempts to buy back the movement give only a small intraday bounce. The MACD indicator has become inactive, but there are signs of divergence at several time frames, so traders should expect a technical rebound. Under such market conditions, traders should consider sell positions from the resistance levels near the moving average since the price has strongly deviated from the averages. Buy trades should be considered only from the support levels of the higher time frame, given the buyers’ initiative, but only with short targets.

Alternative scenario: if the price breaks out through the 1.1386 resistance level and fixes above, the mid-term uptrend will likely resume.

News feed for 2021.11.26:

- Eurozone ECB President Lagarde’s Speech at 10:00 (GMT+2).

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.3323

Prev Close: 1.3320

% chg. over the last day: -0.02%

The UK health secretary said that vaccines may be less effective against the new variant of Covid-19. According to an official government report, the UK failed to prepare properly for a coronavirus pandemic because resources were focused on Brexit. The UK not only recorded the highest number of deaths in Europe – more than 140,000 so far – but it also suffered the sharpest economic hit among the developed countries.

Trading recommendations

Support levels: 1.3307

Resistance levels: 1.3360, 1.3434, 1.3507, 1.3575, 1.3685, 1.3748

On the hourly time frame, the trend on GBP/USD is bearish. The MACD indicator has become inactive but is signaling divergence on several time frames. Under such market conditions, traders should consider sell positions from the support levels around the moving average. The buyers need to get the price back above the 1.3360 level, so buy trades should be considered only if the price returns to the 1.3360-1.3507 corridor, given the buyers’ initiative.

Alternative scenario: if the price breaks out through the 1.3507 resistance level and consolidates above, the bullish scenario will likely resume.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 115.41

Prev Close: 115.31

% chg. over the last day: -0.09%

The Japanese yen strengthened sharply in early Friday trading as a new strain of Covid-19 detected in South Africa sparked a wave of caution in global markets. The Japanese Yen is one of the “safe-haven” currencies in case of emergency shocks.

Trading recommendations

Support levels: 114.38, 113.79, 113.32, 112.87, 112.30

Resistance levels: 115.15, 115.50

The global trend on the USD/JPY currency pair is bullish. But the MACD indicator became negative, and sellers’ pressure is increasing. Under such market conditions, it’s better to look for buy positions from the buyers’ initiative zone near the moving average, but after additional confirmation in the form of a buyers’ initiative. Sell positions should be considered from the resistance levels of higher time frames, given there is sellers’ initiative, but only with short targets.

Alternative scenario: if the price falls below 113.79, the uptrend will likely be broken.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 115.41

Prev Close: 115.31

% chg. over the last day: -0.09%

The Japanese yen strengthened sharply in early Friday trading as a new strain of Covid-19 detected in South Africa sparked a wave of caution in global markets. The Japanese Yen is one of the “safe-haven” currencies in case of emergency shocks.

Trading recommendations

Support levels: 114.38, 113.79, 113.32, 112.87, 112.30

Resistance levels: 115.15, 115.50

The global trend on the USD/JPY currency pair is bullish. But the MACD indicator became negative, and sellers’ pressure is increasing. Under such market conditions, it’s better to look for buy positions from the buyers’ initiative zone near the moving average, but after additional confirmation in the form of a buyers’ initiative. Sell positions should be considered from the resistance levels of higher time frames, given there is sellers’ initiative, but only with short targets.

Alternative scenario: if the price falls below 113.79, the uptrend will likely be broken.