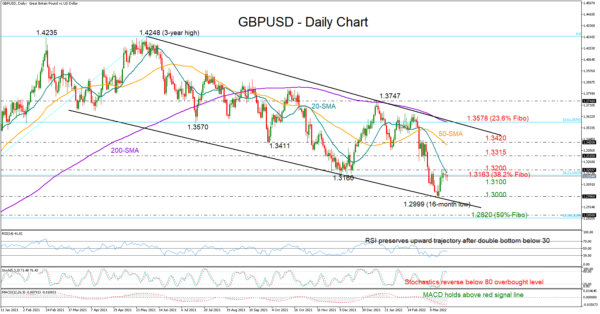

GBPUSD came under fresh selling pressures after its rebound off 1.3000 touched the 20-day simple moving average (SMA) and the 1.3200 round level, with the price decelerating to an intra-day low of 1.3119 on Tuesday. The pair is also struggling to preserve strength above the 23.6% Fibonacci retracement of the 1.1409 – 1.4248 up leg at 1.3163.

The fast Stochastics have pivoted southwards near their 80 overbought level, reflecting fading buying interest. However, with the RSI maintaining its upward trajectory within the bearish region and the MACD, although negative, hovering comfortably above its red signal line, hopes for an upside reversal could persist for a bit longer, especially if the 1.3100 mark manages to add strong footing under the price.

If the above scenario materializes, the pair may re-challenge the 20-day SMA and the 1.3200 number. A successful penetration at this point could send the price towards the 1.3315 barrier, while higher, the 50-day SMA at 1.3390 and the 1.3420 level could be another hurdle. Nevertheless, the bearish trajectory in the broad picture may not face any risks unless the rally extends beyond the 200-day SMA at 1.3578 and the downward-sloping channel.

Should the 1.3100 floor collapse, the door would open for the 1.3000 level. Additional declines from here would worsen the negative outlook below the bearish channel, bringing the 1.2850 handle and the 50% Fibonacci of 1.2820 next into view. Falling lower, the sell-off may take a breather somewhere near 1.2670, which was last active during the April – September 2020 period.

In brief, GBPUSD maintains a bearish outlook in the short-term picture despite last week’s upside reversal. That said, traders may not engage in new selling activities unless the price dives below 1.3100.