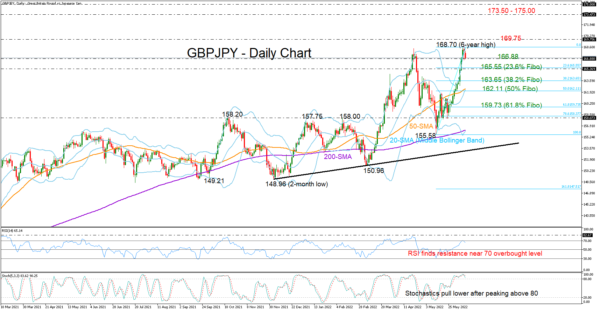

GBPJPY is setting the stage for its next bearish phase after its latest explosive rally topped at a new six-year high of 168.70 and near April’s peak.

The RSI is also pivoting near its 70 overbought mark, while the Stochastics are reversing southwards within the overbought zone too, suggesting that the bull run is overextended and it’s time for a downside correction. It’s worthy to note that the price has been trading along the upper Bollinger band since the start of the month; therefore, a downside move can be technically justified.

Whether the current weakness develops into anything more than a normal bearish correction in an uptrend remains to be seen. Traders are currently having their eye on the nearby barrier of 166.88. If that base cracks, the decline could continue towards the 23.6% Fibonacci of the 155.58 – 168.70 upleg at 165.55. Falling lower, the price may next visit the 38.2% Fibonacci of 163.65, while a decisive close below the 50% Fibonacci of 162.11, where the 20- and 50-day simple moving averages (SMAs) are placed, would eliminate confidence on the latest steep upturn.

Alternatively, if selling tendencies fade immediately around 166.88, buyers may push harder for a break above the 168.70 ceiling, and particularly above the 169.75 barricade taken from January-February 2016. If that turns out to be the case, the rally may speed up to the 173.50 – 175.00 restrictive region last seen during the 2013 – 2016 period.

In short, GBPJPY is expected to give up some of its recent impressive gains in the coming sessions. A clear close below 166.80 may activate fresh selling pressures.