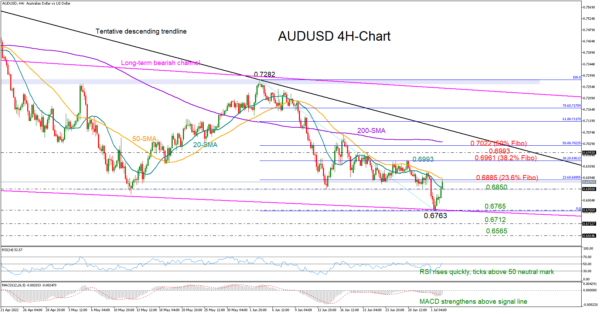

AUDUSD switched to a bullish mode after stepping again on the bottom line of the 2021 bearish channel at 0.6765 last Friday.

The pair has almost recouped Friday’s loss ahead of the RBA rate decision due on Tuesday at 04:30 GMT, but the 50-period simple moving average (SMA) on the four-hour chart, which has been a key constraining zone since the start of June, is still overhead at 0.6890. Note that the 23.6% Fibonacci retracement of the 0.7282 – 0.6763 downleg is sitting around the same level too.

On the other hand, the fast progress in the RSI, which is looking to exit the bearish area, and the growth in the MACD, which has climbed back above its red signal line, is boosting optimism that the pair may extend its recovery in the short term. The 38.2% Fibonacci of 0.6961 may come first into view in this case. A more aggressive rally could even reach the 0.6993 resistance, where a close higher could see another test near the 200-period SMA and the 50% Fibonacci of 0.7022.

In the bearish scenario, where the price flips back below the nearby support of 0.6850, the way will clear again towards the channel’s lower boundary seen around 0.6765. Failure to bounce here could trigger a quick decline towards the 0.6565 handle taken from April-May 2020.

All in all, although the short-term bias is improving for AUDUSD, buyers may wisely wait for a close above the familiar barrier of 0.6885 before they drive the price towards 0.6961.