Key Highlights

- Gold price started a downside correction from the $1,786 level.

- It traded below a short-term rising channel with support at $1,775 on the 4-hours chart.

- Crude oil price tested the $76.50 zone before it recovered.

- The US Manufacturing PMI could drop to 49.8 in Nov 2022 (Preliminary).

Gold Price Technical Analysis

Gold price formed a base above the $1,650 level against the US Dollar. The price started a steady increase above the $1,700 and $1,740 levels.

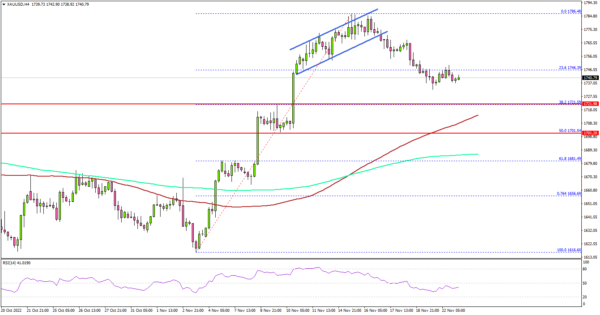

The 4-hours chart of XAU/USD indicates that the price gained pace above the $1,750 resistance zone. The price even moved above the $1,775 level and traded as high as $1,786. Recently, there was a downside correction below the $1,775 level.

The price traded below a short-term rising channel with support at $1,775 on the same chart. It even dropped below the 23.6% Fib retracement level of the upward move from the $1,616 swing low to $1,786 high.

On the downside, an initial support is near the $1,725 level. The next major support is near the $1,710 level or the 100 simple moving average (red, 4-hours).

The main support is near $1,700 or the 50% Fib retracement level of the upward move from the $1,616 swing low to $1,786 high, below which gold price might struggle to stay above the 200 simple moving average (green, 4-hours).

On the upside, the price might face sellers near the $1,765 level. The next major resistance is near the $1,775 level. Any more gains might send the price towards the $1,786 resistance level, above which gold price might revisit the $1,800 resistance.

Looking at crude oil price, there was a sharp decline towards the $76.50 support zone, where the bulls took a strong stand.

Economic Releases to Watch Today

- Germany’s Manufacturing PMI for Nov 2022 (Preliminary) – Forecast 45.0, versus 45.1 previous.

- Germany’s Services PMI for Nov 2022 (Preliminary) – Forecast 46.2, versus 46.5 previous.

- Euro Zone Manufacturing PMI for Nov 2022 (Preliminary) – Forecast 46.0, versus 46.4 previous.

- Euro Zone Services PMI for Nov 2022 (Preliminary) – Forecast 48.0, versus 48.6 previous.

- UK Manufacturing PMI for Nov 2022 (Preliminary) – Forecast 45.8, versus 46.2 previous.

- UK Services PMI for Nov 2022 (Preliminary) – Forecast 48.0, versus 48.8 previous.

- US Manufacturing PMI for Nov 2022 (Preliminary) – Forecast 49.8, versus 50.4 previous.

- US Services PMI for Nov 2022 (Preliminary) – Forecast 47.7, versus 47.8 previous.

- US Initial Jobless Claims – Forecast 224K, versus 222K previous.

- US New Home Sales for Oct 2022 (MoM) – Forecast -3.8%, versus -10.9% previous.